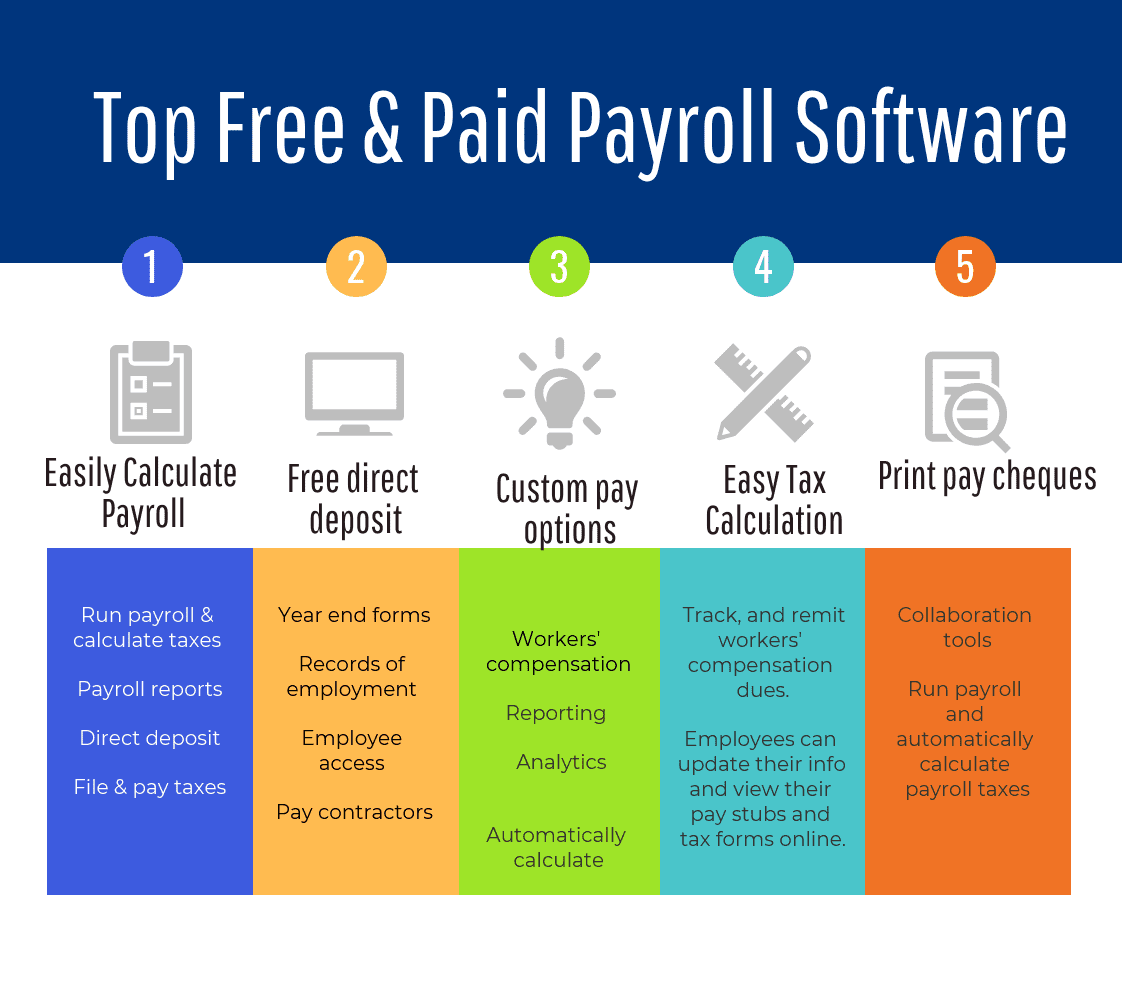

Understand the software’s core features: Begin by familiarizing yourself with the core features of the payroll software in UAE. This includes functions such as employee data management, attendance tracking, time and leave management, and salary calculations. Gain a thorough understanding of each feature to fully utilize the software’s capabilities.

Understand the software’s core features: Begin by familiarizing yourself with the core features of the payroll software in UAE. This includes functions such as employee data management, attendance tracking, time and leave management, and salary calculations. Gain a thorough understanding of each feature to fully utilize the software’s capabilities.

In today’s digital age, businesses in the United Arab Emirates are constantly seeking ways to streamline their operations and enhance efficiency. One crucial aspect of any organization is payroll management. Managing employee salaries, attendance, and leave can be a daunting task, especially for large companies. However, with the advancement of technology, payroll software in the UAE has emerged as a game-changer, simplifying and automating these processes. To make the most of this software, it is essential to understand its core features.

First and foremost, employee data management is a fundamental function of payroll software. This feature allows you to store and manage all relevant information about your employees, such as their personal details, contact information, and employment history. By centralizing this data, you can easily access, update, and retrieve employee records whenever required. This feature also ensures data accuracy and security, reducing the likelihood of errors or data breaches.

Attendance tracking is another vital feature of payroll software. It enables you to record and monitor employee attendance, whether through manual entries, biometric systems, or card swipes. This feature provides real-time insights into employees’ working hours, late arrivals, and early departures. By accurately tracking attendance, you can ensure fair compensation for your employees and discourage any unethical practices.

Time and leave management is an indispensable aspect of payroll software. With this feature, you can effortlessly manage employee leave requests, track leave balances, and accurately calculate leave entitlements. This ensures that employees are entitled to the right amount of leave and are not taken advantage of. Moreover, this feature allows you to generate reports on leave patterns, helping you identify trends and implement strategies to improve workforce management.

Salary calculations are perhaps the most critical feature of any payroll software. This feature automates the complex process of calculating employee salaries, incorporating factors such as basic pay, overtime, allowances, deductions, and taxes. By eliminating manual calculations, you can minimize errors and save valuable time. Additionally, this feature generates accurate pay slips, reducing any disputes or confusion regarding salary calculations.

In conclusion, understanding the core features of payroll software in the UAE is crucial for effectively managing your organization’s payroll processes. By familiarizing yourself with functions such as employee data management, attendance tracking, time and leave management, and salary calculations, you can harness the full potential of this software. Embracing technology in payroll management not only enhances accuracy and efficiency but also frees up valuable time for HR professionals to focus on strategic initiatives. So, take the time to explore and fully utilize the capabilities of payroll software in the UAE, and watch as your payroll management becomes a seamless and hassle-free process.

Customizing payroll software to meet the specific needs of your organization is essential for efficient and accurate payroll management. Payroll software offers flexibility and customization options that can be tailored to align with your company’s unique payroll policies, tax regulations, and reporting needs. By taking advantage of these features, you can streamline your payroll processes and ensure precise calculations.

One of the primary benefits of customizing payroll software is the ability to automate and simplify complex payroll calculations. Every organization has its own set of payroll policies, including overtime calculations, bonuses, and deductions. By configuring the software to reflect your company’s specific policies, you can automate these calculations, reducing the risk of errors and saving valuable time.

Tax regulations also vary from one jurisdiction to another, and it is crucial to comply with these requirements accurately. Payroll software allows you to customize tax settings based on the applicable regulations in your region. By inputting the correct tax rates and thresholds, you can ensure that employee taxes are accurately calculated and deducted, reducing the risk of non-compliance and potential penalties.

Furthermore, reporting requirements differ across organizations, and it is vital to generate accurate and comprehensive reports for various stakeholders. Payroll software can be customized to generate reports that provide valuable insights into payroll costs, employee earnings, tax liabilities, and more. By tailoring the software to include the specific data fields and formats required by your organization, you can easily generate reports that meet the needs of management, accountants, and regulatory bodies.

Customizing payroll software also allows you to integrate it seamlessly with other systems and software used within your organization. This ensures smooth data flow and eliminates the need for manual data entry, reducing the risk of errors and improving overall efficiency. By integrating payroll software with other systems, such as human resources or accounting software, you can streamline processes and save time and effort.

In conclusion, customizing payroll software to align with your organization’s needs is crucial for efficient payroll management. By configuring the software to reflect your company’s unique payroll policies, tax regulations, and reporting requirements, you can streamline processes, ensure accurate calculations, and save time. Take advantage of the customization options offered by payroll software to automate complex calculations, comply with tax regulations, generate comprehensive reports, and seamlessly integrate with other systems. By doing so, you can enhance your payroll operations and contribute to the overall success of your organization.

One of the major benefits of using payroll software is its ability to automate routine tasks. Payroll processing involves numerous repetitive and time-consuming tasks, such as calculating salaries, deducting taxes, and generating employee payslips. By utilizing payroll software, businesses can streamline these processes and enjoy a range of advantages.

Automating payroll tasks brings about significant time savings. Manual calculations and data entry can be extremely time-consuming, especially for larger organizations with numerous employees. Payroll software eliminates the need for manual calculations, as it can accurately perform complex salary calculations in a matter of seconds. This frees up valuable time for HR and payroll teams, allowing them to focus on more strategic and value-added activities.

In addition to saving time, automated payroll systems also help reduce errors. Manually calculating salaries and tax deductions can lead to mistakes, which can be costly for both employers and employees. Payroll software minimizes the risk of errors by accurately performing calculations based on predefined rules and regulations. This ensures that employees receive their correct salaries and deductions are accurately applied, improving overall payroll accuracy and compliance.

Another advantage of automated payroll systems is the generation of payslips. Previously, creating payslips involved manual data entry and formatting. With payroll software, payslips can be automatically generated and distributed to employees. This not only saves time but also ensures that payslips are consistent and error-free. Employees can access their payslips online or through a self-service portal, enhancing convenience and transparency.

Furthermore, payroll software provides businesses with improved efficiency in managing payroll. Automated systems can store and organize vast amounts of employee data, such as personal details, salary history, and tax information. This centralized database allows for easy retrieval of information, simplifying payroll processes and ensuring data accuracy. Additionally, payroll software can generate various reports and analytics, providing valuable insights into labor costs, employee salaries, and tax liabilities.

In conclusion, utilizing payroll software offers several benefits, including the automation of routine tasks. By automating salary calculations, tax deductions, and payslip generation, businesses can save time, reduce errors, and improve overall efficiency in managing payroll. Payroll software streamlines payroll processes, increases accuracy, and provides valuable reporting capabilities. As a result, businesses can focus on strategic activities and enhance their overall payroll management.

Utilize reporting and analytics features: Payroll software offers a wide range of reporting and analytics capabilities that can provide valuable insights into your organization’s payroll data. These features are designed to help you effectively manage your payroll processes and make informed decisions based on accurate and up-to-date information.

One of the key benefits of utilizing reporting and analytics features is the ability to generate reports on salary trends. By analyzing data on employee salaries, you can identify patterns and trends in compensation, helping you ensure that your organization’s salary structure is competitive and fair. This information can also be used to make adjustments to salary scales, ensuring that your employees are appropriately compensated for their skills and experience.

In addition to salary trends, reporting and analytics features can also provide insights into employee expenses. By tracking and analyzing expenses such as travel, training, and benefits, you can gain a better understanding of the overall cost of employing your workforce. This information can help you identify areas where expenses can be reduced or optimized, contributing to cost savings for your organization.

Another important aspect of payroll reporting and analytics is the ability to monitor and manage tax liabilities. Payroll software can generate reports that provide a comprehensive overview of tax obligations, helping you ensure compliance with tax regulations and avoid any potential penalties. By analyzing this data, you can identify any discrepancies or errors in tax calculations, allowing you to take corrective action and avoid any potential issues with tax authorities.

In summary, the reporting and analytics features of payroll software offer significant benefits for organizations. By utilizing these features, you can generate reports on salary trends, employee expenses, and tax liabilities, enabling you to make informed decisions, identify cost-saving opportunities, and ensure compliance with regulations. By harnessing the power of data, you can streamline your payroll processes and contribute to the overall success of your organization. So, make sure you take advantage of these features and unlock the full potential of your payroll software.

Stay updated with software upgrades and training: Payroll software providers regularly release updates and new features to enhance functionality and address any issues. It is essential for businesses to stay informed about these updates and make sure to upgrade their software to the latest version. By doing so, they can take advantage of the latest improvements and ensure that their payroll processes remain efficient and up to date.

Additionally, it is crucial for businesses to invest in training programs or resources provided by the software vendor. These training programs help ensure that both the business owners and their team are fully proficient in utilizing all the best features of the payroll software in UAE. By becoming experts in using the software, businesses can streamline their payroll processes, save time, and minimize the risk of errors.

The benefits of staying updated with software upgrades are numerous. Firstly, software updates often include bug fixes and security patches, which help protect sensitive payroll data from cyber threats and potential breaches. By neglecting to update the software, businesses leave themselves vulnerable to hackers and other malicious actors who may exploit any existing vulnerabilities.

Furthermore, software updates are designed to enhance functionality and user experience. These updates can introduce new features that simplify payroll calculations, automate manual tasks, and improve reporting capabilities. By utilizing these features, businesses can reduce the time and effort spent on payroll management, allowing them to focus on other essential aspects of their operations.

In addition to software upgrades, investing in training programs is equally important. These programs provide businesses with the opportunity to learn about new features and best practices directly from the software vendor. By understanding how to maximize the software’s potential, businesses can optimize their payroll processes and ensure accurate and timely payments to their employees.

Moreover, training programs allow businesses to train new employees or upskill existing staff members. This ensures that everyone involved in payroll management is well-equipped to handle the software effectively. By doing so, businesses minimize the risk of errors and reduce the need for constant supervision or assistance, fostering independence and efficiency within the team.

In conclusion, staying updated with software upgrades and investing in training programs is crucial for businesses utilizing payroll software in UAE. By upgrading to the latest version and participating in training programs, businesses can take full advantage of the software’s features, enhance functionality, and ensure the security of their payroll data. Ultimately, this leads to streamlined payroll processes, reduced errors, and increased productivity for the business as a whole.