Bitcoin has been a hot topic of conversation in recent years, with its value soaring to new heights and making headlines worldwide. But with all the buzz surrounding this digital currency, it’s important to understand the potential risks and rewards of investing in Bitcoin. This article aims to shed some light on the subject, discussing key factors such as price volatility, market manipulation, and security concerns.

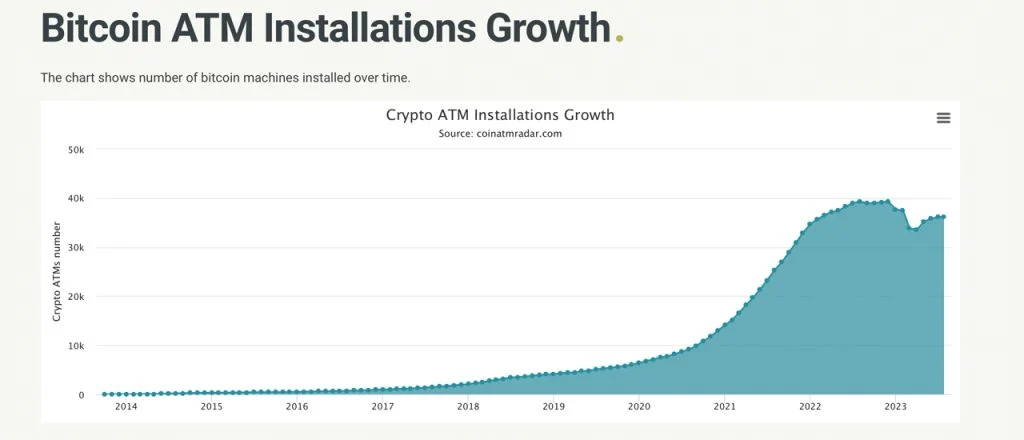

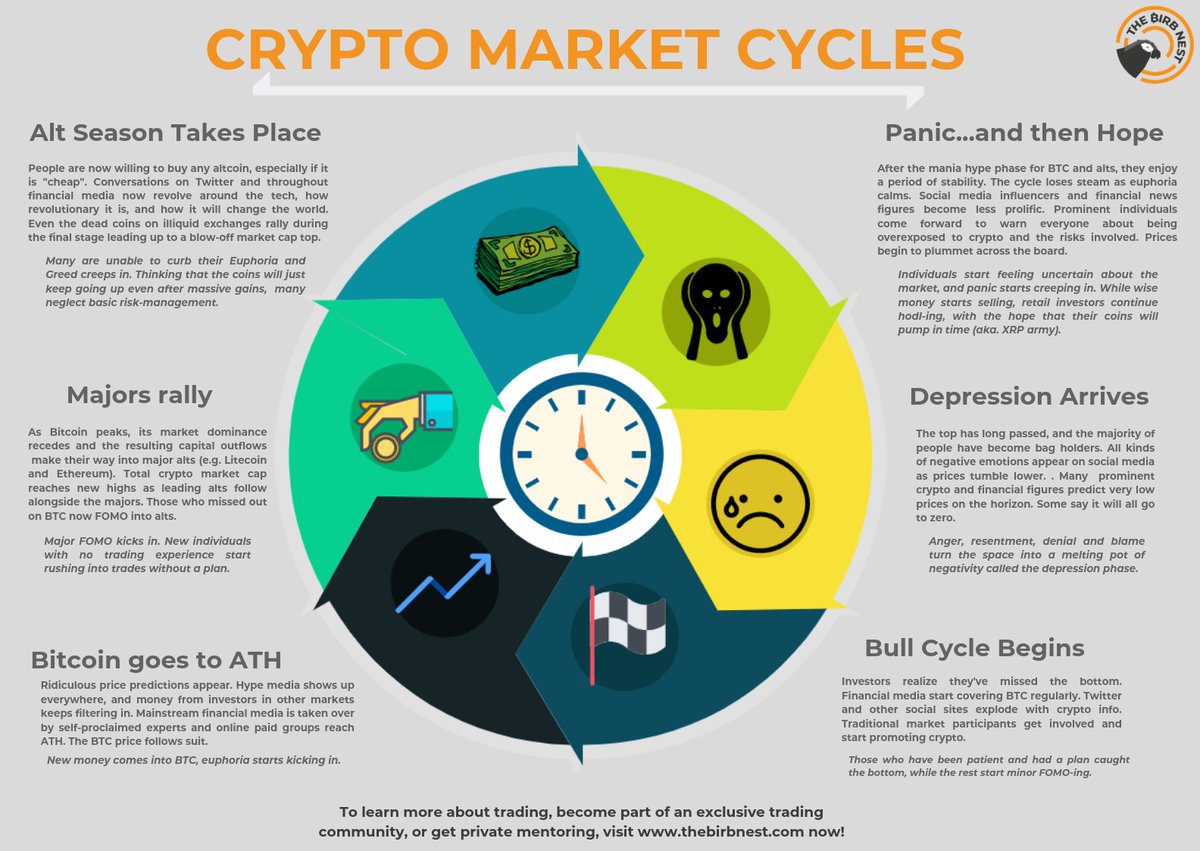

Price volatility is one of the first things that comes to mind when considering Bitcoin as an investment. Unlike traditional currencies, Bitcoin is not backed by any government or central authority, making its value highly unpredictable. The price of Bitcoin can fluctuate dramatically in a short period, which can be both a risk and a potential reward. While some investors have made substantial profits by buying Bitcoin at a low price and selling it when the value soared, others have suffered significant losses due to sudden price drops. Therefore, it is crucial to carefully analyze market trends and make well-informed decisions to minimize the risks associated with such volatility.

Another risk to consider when investing in Bitcoin is market manipulation. Due to its decentralized nature and lack of regulation, the cryptocurrency market is susceptible to manipulation by large investors and even fraudulent activities. Whales, those who hold a substantial amount of Bitcoin, can influence the market by buying or selling large amounts of the digital currency. This can create artificial price movements, making it challenging for small investors to predict and profit from such market dynamics. Therefore, it is essential to stay updated on market news, be cautious of pump and dump schemes, and consider the credibility of the platforms on which you trade or store your Bitcoins.

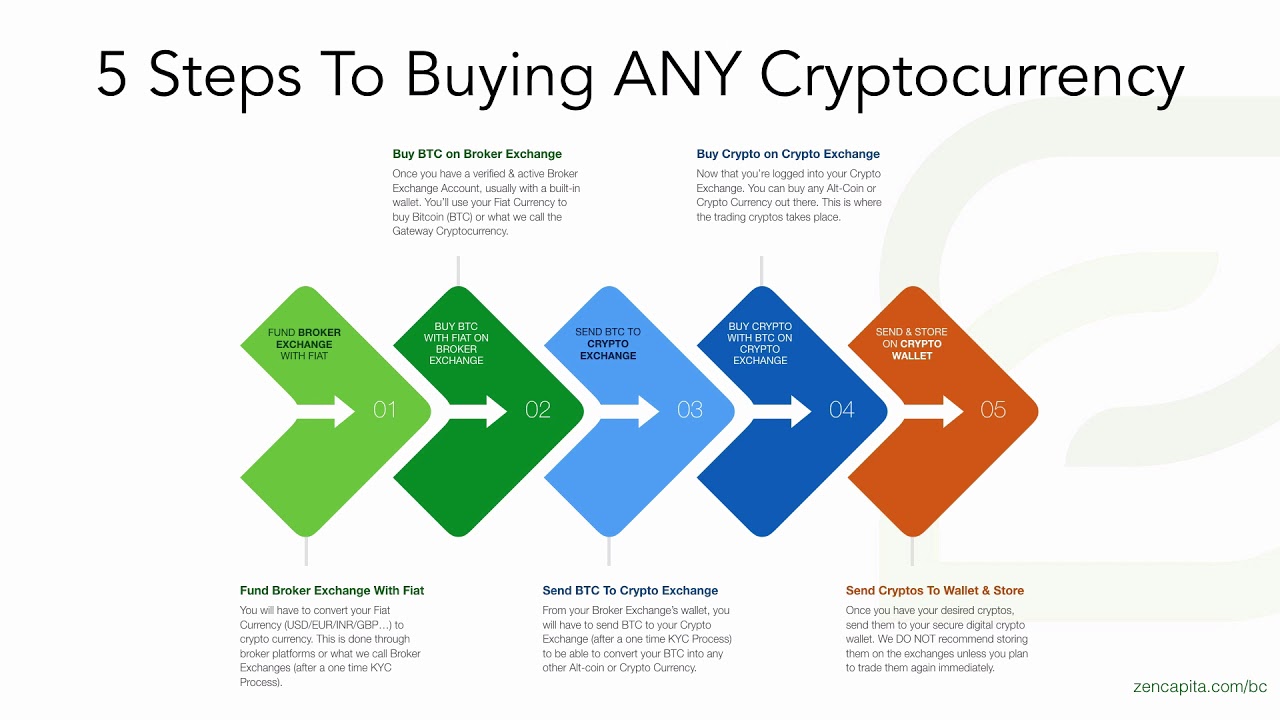

Security concerns are another significant factor to keep in mind. While Bitcoin transactions are recorded on a public ledger called the blockchain, the digital wallets used to store the cryptocurrency can be vulnerable to hacking and theft. There have been instances of exchanges being hacked, resulting in the loss of millions of dollars worth of Bitcoins. To mitigate this risk, it is crucial to choose reputable and secure wallet providers, implement strong security measures such as two-factor authentication, and regularly update your software. Additionally, diversifying your investments and not keeping all your Bitcoins in one place can also help minimize potential losses.

In conclusion, investing in Bitcoin can bring both rewards and risks. The price volatility may offer lucrative opportunities for profit, but it also poses a significant risk of losses. Market manipulation and security concerns further complicate the investment landscape. However, by staying informed, conducting thorough research, and taking appropriate security measures, investors can navigate these challenges and potentially benefit from the exciting world of Bitcoin. As with any investment, it’s important to carefully weigh the risks and rewards before making any decisions and only invest what you can afford to lose.

Investment Strategies:

When it comes to investing, there are various strategies that individuals can employ to maximize their returns and minimize risks. In this article, we will outline three popular investment strategies – buying and holding, dollar-cost averaging, and diversification – and provide specific examples of how these strategies have worked for investors in the past.

The first strategy, buying and holding, involves purchasing investments with the intention of holding onto them for an extended period. This approach relies on the belief that over time, the value of the investments will increase, despite short-term market fluctuations. For instance, Warren Buffett, one of the most successful investors of all time, has famously applied this strategy with great success. He often advises investors to “be fearful when others are greedy, and be greedy when others are fearful.” By staying invested for the long term, Buffett has seen substantial returns on his investments.

Another strategy worth considering is dollar-cost averaging. This method involves investing a fixed amount of money at regular intervals, regardless of market conditions. By consistently investing the same amount, individuals can take advantage of market downturns and acquire more shares when prices are low, thereby reducing the average cost per share. This strategy is particularly beneficial for beginner investors who may be intimidated by market volatility. An example of the effectiveness of dollar-cost averaging can be seen during the Great Recession of 2008. Investors who continued to invest set amounts during the downturn were able to accumulate a larger number of shares at lower prices, resulting in significant gains when the market eventually recovered.

Diversification is yet another essential investment strategy. This approach involves spreading investments across various asset classes, industries, and geographic regions to reduce the risk associated with having all eggs in one basket. By diversifying, investors can potentially offset losses in one investment with gains in another. A notable example of diversification’s success can be found in the 2000 dot-com bubble burst. Many investors who had heavily invested in technology stocks experienced substantial losses. However, those who had diversified their portfolios with a mix of stocks, bonds, and real estate, were better protected from the tech sector’s downfall.

In conclusion, having a clear investment strategy is crucial for achieving long-term financial goals. Whether it be buying and holding, dollar-cost averaging, or diversification, each strategy has its merits and has proven successful for investors in the past. By following the examples set by renowned investors like Warren Buffett and learning from historical events such as the Great Recession and the dot-com bubble, individuals can make informed investment decisions and increase their chances of building wealth over time. Remember, always consult with a financial advisor or do thorough research before implementing any investment strategy.

Security Measures: Protecting Your Bitcoin Investment

In the fast-paced digital world, where cryptocurrencies have gained immense popularity, it is crucial to prioritize the security of your Bitcoin investment. With the potential risks posed by hackers and other cyber threats, it is essential to take necessary precautions to safeguard your digital assets. This article will guide you through some effective security measures that you should consider implementing to protect your Bitcoin investment.

One of the most fundamental security measures is to use a hardware wallet. Unlike online wallets, which are vulnerable to hacking attempts, hardware wallets store your private keys offline, providing an extra layer of protection. These small devices, resembling USB drives, are designed to securely store your private keys and authorize transactions. By keeping your Bitcoin holdings offline, you significantly reduce the risk of unauthorized access or theft.

In addition to using a hardware wallet, backing up your private keys is vital to ensure the security of your Bitcoin investment. Private keys are the digital codes that grant you access to your Bitcoin wallet. Losing these keys can lead to irreversible loss of your funds. Therefore, it is crucial to regularly create backups of your private keys and store them in secure offline locations, such as external hard drives or encrypted USBs. By doing so, you can easily recover your funds in case your hardware wallet is lost, stolen, or damaged.

Moreover, adopting offline storage solutions is another effective security measure to protect your Bitcoin investment. Consider storing your Bitcoin holdings in cold storage wallets, which are offline wallets specifically designed to keep your digital assets secure. Cold storage wallets are not connected to the internet, eliminating the risk of online attacks. These wallets can come in various forms, such as paper wallets or specialized hardware devices. By keeping your Bitcoin offline, you minimize the chances of cybercriminals gaining access to your funds.

Furthermore, taking measures to enhance the privacy of your Bitcoin transactions is crucial. While Bitcoin transactions are recorded on the blockchain and are inherently transparent, you can still implement additional privacy measures. Utilize mixing services or CoinJoin protocols to obfuscate the origin and destination of your Bitcoin transactions. By mixing your coins with those of others, you can make it more challenging for anyone to trace your transaction history. Additionally, consider using multiple addresses for your Bitcoin holdings, making it more difficult for prying eyes to link your transactions together.

In conclusion, securing your Bitcoin investment is paramount in the ever-evolving digital landscape. By implementing the recommended security measures, such as using a hardware wallet, backing up your private keys, and keeping your Bitcoin holdings offline, you can significantly reduce the risk of unauthorized access or loss. Remember to stay informed about the latest security practices and regularly update your security measures to adapt to emerging threats. By prioritizing security, you can confidently navigate the world of cryptocurrencies and protect your valuable Bitcoin investment.

The regulatory environment surrounding Bitcoin investments is a crucial aspect that every investor needs to consider. With the increasing popularity of cryptocurrencies, governments around the world are gradually developing policies and regulations to govern their use, including tax implications and legal considerations.

One of the key factors to keep in mind when investing in Bitcoin is the tax implications. As with any investment, it is essential to understand how your profits will be taxed. Different countries have varying regulations when it comes to taxing cryptocurrencies, so it is vital to consult with a tax professional or seek guidance from your local tax authority. By understanding the tax implications, you can better plan your investments and avoid any unnecessary surprises when it comes to filing your tax returns.

Legal considerations are also paramount when investing in Bitcoin. While cryptocurrencies offer exciting opportunities, they operate in an ever-evolving legal landscape. As governments strive to regulate digital currencies, it is essential to stay informed about any legal developments that may impact your investments. This includes keeping track of any proposed regulations, laws, or court cases related to cryptocurrencies in your jurisdiction. By staying informed, you can ensure that your investments are in compliance with the law, mitigating any potential legal risks that may arise.

Staying updated on changes in regulation is crucial for making informed investment decisions. The regulatory environment surrounding Bitcoin is continuously evolving, and being aware of any new policies or guidelines can help you assess the potential risks and rewards of investing in this digital currency. By keeping an eye on regulatory changes, you can adapt your investment strategy accordingly, ensuring that your portfolio remains aligned with the legal framework.

Moreover, staying informed about regulations can also give you a competitive edge in the market. As new regulations are introduced, some investors may become hesitant or even exit the market entirely. This can create opportunities for those who are well-informed and prepared to navigate the evolving regulatory landscape. By understanding the rules and regulations, you can position yourself to make well-timed investment decisions that may offer significant returns.

In conclusion, the regulatory environment surrounding Bitcoin investments encompasses tax implications and legal considerations. To make better investment decisions, it is crucial to stay informed about regulatory changes and understand how they may impact your investments. By considering tax implications, staying updated on legal developments, and adapting your investment strategy accordingly, you can navigate the evolving regulatory landscape and position yourself for potential success in the world of Bitcoin investments.