Educate yourself: Begin by educating yourself about cryptocurrencies, blockchain technology, and the basics of investing. Understand key terms and concepts such as wallets, exchanges, public and private keys, and different types of cryptocurrencies. Stay updated with industry news and trends.

Educate yourself: Begin by educating yourself about cryptocurrencies, blockchain technology, and the basics of investing. Understand key terms and concepts such as wallets, exchanges, public and private keys, and different types of cryptocurrencies. Stay updated with industry news and trends.

In today’s rapidly evolving world, cryptocurrencies have emerged as an exciting and potentially lucrative investment opportunity. However, before diving headfirst into the world of digital currencies, it is essential to equip yourself with the necessary knowledge and understanding. By educating yourself about cryptocurrencies, blockchain technology, and the fundamentals of investing, you can make informed decisions and navigate this dynamic landscape with confidence.

To start your journey, immerse yourself in the world of cryptocurrencies by gaining a thorough understanding of key terms and concepts. Familiarize yourself with wallets, which are digital tools that enable you to securely store and manage your cryptocurrencies. Additionally, learn about exchanges, platforms where you can buy, sell, and trade cryptocurrencies. Understanding the difference between public and private keys is crucial, as these cryptographic codes grant access to your digital assets. Moreover, explore the various types of cryptocurrencies available in the market, such as Bitcoin, Ethereum, and Litecoin, to grasp their unique features and potential.

Staying updated with industry news and trends is paramount in the fast-paced world of cryptocurrencies. Follow reputable news sources, subscribe to newsletters, and join online communities to keep yourself informed about the latest developments. Regularly reading articles, attending webinars, and engaging in discussions with experts can further enhance your knowledge. By staying in the loop, you can anticipate market shifts, understand regulatory changes, and capitalize on potential investment opportunities.

Blockchain technology, the driving force behind cryptocurrencies, is another crucial aspect to comprehend. This decentralized digital ledger system ensures transparency and security in transactions. Understanding how blockchain operates and its potential applications beyond cryptocurrencies can provide valuable insights into the future of finance, supply chain management, and various other industries. By grasping the transformative power of blockchain, you can identify promising projects and assess their potential for long-term success.

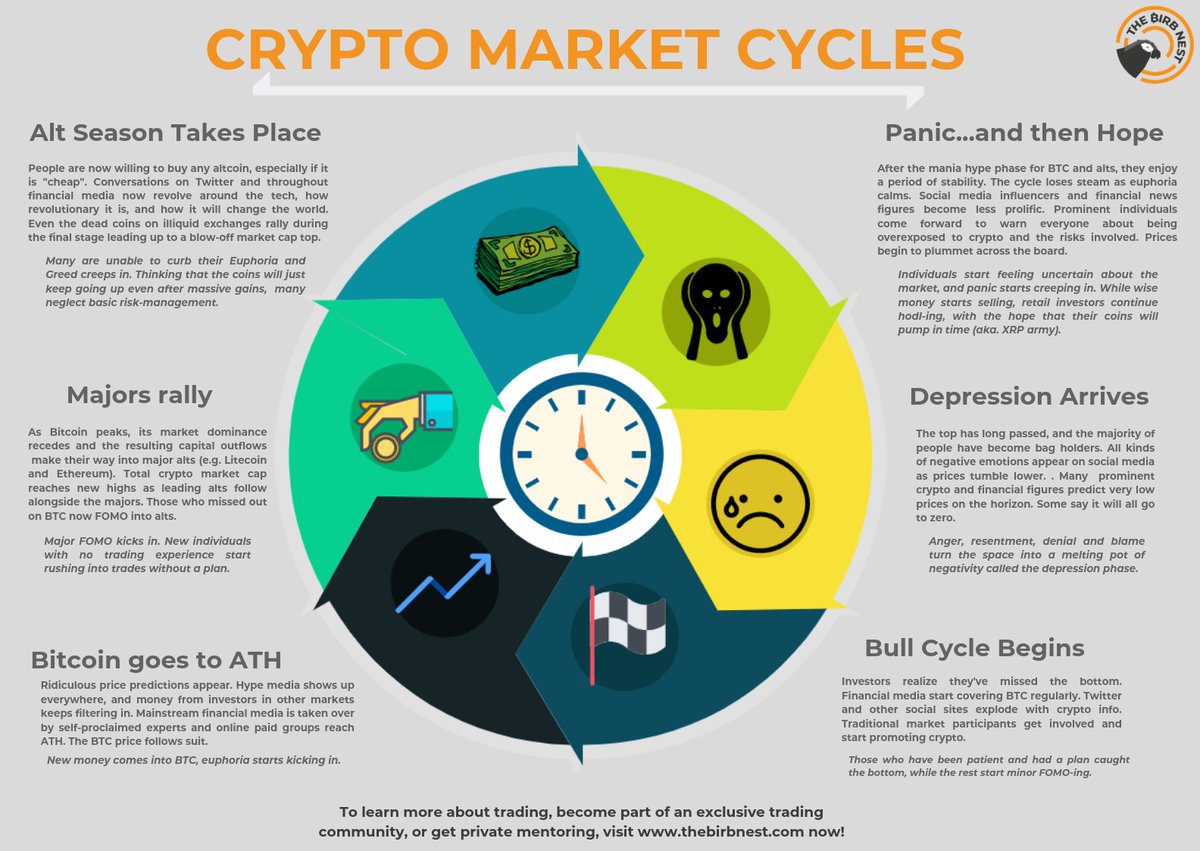

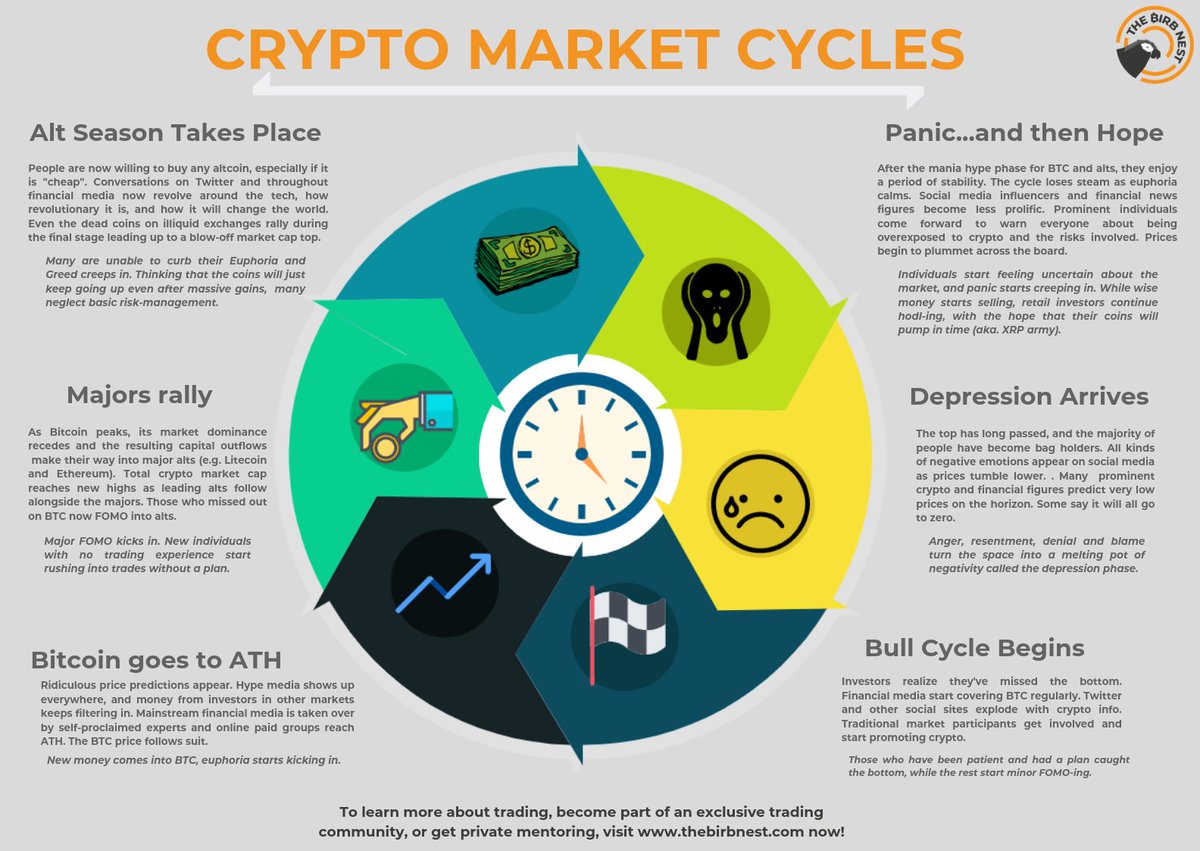

Investing in cryptocurrencies carries inherent risks, as prices can fluctuate rapidly. Educating yourself about investment principles and strategies is essential to mitigate these risks. Diversification, setting realistic goals, and conducting thorough research before making investment decisions are key factors to consider. Additionally, understand the importance of risk management and never invest more than you can afford to lose. By approaching cryptocurrency investments with a prudent and informed mindset, you can maximize your chances of success.

In conclusion, embarking on your cryptocurrency journey requires a solid foundation of knowledge and understanding. Educate yourself about cryptocurrencies, blockchain technology, and the basics of investing to navigate this ever-evolving landscape effectively. Stay updated with industry news, grasp key terms and concepts, and explore the potential of blockchain beyond cryptocurrencies. By taking these steps, you can position yourself to make informed investment decisions and potentially capitalize on the exciting opportunities presented by cryptocurrencies.

Set clear goals and risk tolerance: Determine your investment goals and assess your risk tolerance. Decide whether you want to invest in cryptocurrencies for the long term or engage in short-term trading. Establishing clear goals and understanding your risk appetite will help you make informed decisions.

Investing in cryptocurrencies can be a lucrative venture, but it is not without its risks. Before dipping your toes into the volatile world of digital currencies, it is crucial to set clear goals and assess your risk tolerance. By doing so, you can navigate the market with a sense of purpose and make informed investment decisions.

Firstly, determine your investment goals. Are you looking to grow your wealth over the long term or make quick profits through short-term trading? Understanding your objectives will guide your investment strategy and determine the types of cryptocurrencies you should consider. If you seek stability and long-term growth, you may opt for established coins like Bitcoin or Ethereum. On the other hand, if you’re comfortable with higher risks and potential rapid gains, you might explore newer, emerging cryptocurrencies with promising technology.

Alongside setting goals, assessing your risk tolerance is equally important. Investing in cryptocurrencies can be highly volatile, with prices fluctuating dramatically in short periods. Some investors can stomach these price swings, while others may find them nerve-wracking. Evaluating your risk appetite will help you determine how much you are willing to invest and tolerate potential losses. Remember, it’s essential to only invest what you can afford to lose, as the cryptocurrency market can be unpredictable.

Once you have established your goals and risk tolerance, you can make more informed decisions regarding your cryptocurrency investments. By being clear about your objectives, you can filter through the vast number of available coins and focus on those that align with your goals. You can also determine the appropriate allocation of your investment portfolio, dividing your resources between different cryptocurrencies based on your desired risk-reward ratio.

Moreover, understanding your risk appetite will prevent you from making impulsive decisions during market fluctuations. The cryptocurrency market can experience significant price swings in a matter of hours, causing panic and uncertainty. However, if you have already assessed your risk tolerance beforehand, you will be better equipped to stay calm and make rational choices. Avoid being swayed by market noise or succumbing to fear and greed, as these emotions often cloud judgment and lead to poor investment decisions.

In conclusion, setting clear goals and understanding your risk tolerance are crucial steps before venturing into the world of cryptocurrency investments. By determining your objectives and assessing how much risk you can handle, you can make informed choices that align with your financial aspirations. Remember, investing in cryptocurrencies can be highly rewarding, but also highly volatile. With the right mindset and a well-defined investment plan, you can navigate the market with confidence and increase your chances of success.

Choose a reliable exchange and wallet: Research and select a reputable cryptocurrency exchange that suits your needs. Consider factors like security measures, user-friendliness, available cryptocurrencies, fees, and customer support. Additionally, set up a secure digital wallet to store your cryptocurrencies.

In the ever-evolving world of cryptocurrencies, it is essential to choose a reliable exchange and wallet to ensure the safety and security of your digital assets. With numerous options available in the market, it can be overwhelming to make the right choice. However, with a little research and consideration of a few key factors, you can find an exchange and wallet that perfectly align with your requirements.

The first step is to thoroughly research and select a reputable cryptocurrency exchange. Look for exchanges that have a solid track record and positive feedback from users. Consider their security measures, as the security of your funds should be a top priority. Look for features like two-factor authentication and cold storage wallets, which provide an extra layer of protection against unauthorized access.

User-friendliness is another crucial factor to consider when choosing an exchange. The platform should be intuitive and easy to navigate, especially for beginners. A complex and confusing interface can lead to unnecessary frustrations and potential mistakes. Look for exchanges that offer a user-friendly interface with clear instructions and guides.

The range of available cryptocurrencies is also an important consideration. Different exchanges support different cryptocurrencies, so ensure that the exchange you choose supports the specific cryptocurrencies you intend to trade or invest in. This will allow you to have a diversified portfolio and take advantage of various investment opportunities.

Fees are another aspect that should not be overlooked. Different exchanges have different fee structures, and these fees can significantly impact your trading or investment returns. Some exchanges charge a flat fee per transaction, while others have a percentage-based fee. Take the time to compare the fee structures of various exchanges to find the one that offers the best value for your money.

Customer support is often an overlooked factor, but it is crucial in case you encounter any issues or have questions regarding your transactions or account. Look for exchanges that provide responsive customer support through various channels like email, live chat, or phone. Prompt and helpful customer support can make a significant difference in resolving any problems efficiently.

Additionally, it is vital to set up a secure digital wallet to store your cryptocurrencies. While some exchanges offer integrated wallets, it is recommended to have a separate wallet under your control. A digital wallet acts as a secure vault for your digital assets, protecting them from potential hacks or thefts. Choose a wallet that offers advanced security features like multi-signature authentication, encryption, and offline storage.

In conclusion, choosing a reliable cryptocurrency exchange and wallet is a crucial step in your cryptocurrency journey. Research and consider factors like security measures, user-friendliness, available cryptocurrencies, fees, and customer support. Set up a secure digital wallet to ensure the safety of your digital assets. By making informed choices, you can confidently venture into the world of cryptocurrencies and navigate it with ease.

Start with a small investment: As a debutant in the world of investing, it is crucial to approach this endeavor with caution and prudence. One of the key recommendations for beginners is to start with a small investment. By beginning with an amount of money that you are comfortable potentially losing, you can mitigate the risks associated with investing while also gaining valuable experience.

Starting small allows you to dip your toes into the market without exposing yourself to significant financial losses. It helps you understand the intricacies and dynamics of the market, learning how it reacts to various factors such as economic news, geopolitical events, and investor sentiment. This initial phase serves as a crucial learning curve, enabling you to grasp the basics of investing and build a solid foundation for future endeavors.

Moreover, starting with a small investment provides you with the opportunity to assess your risk tolerance and investment style. Each investor is unique, and what may work for others may not necessarily align with your own financial goals and comfort levels. By experimenting with a smaller amount, you can analyze your emotional response to market fluctuations, identify your investment preferences, and adjust your strategy accordingly.

Another advantage of starting small is the ability to diversify your investments. With a limited budget, you can invest in different asset classes, sectors, or geographical regions. Diversification is a widely recognized risk management strategy that helps reduce the impact of any single investment failing. By spreading your investment across various opportunities, you lower the overall risk and increase your chances of earning consistent returns.

Furthermore, starting with a small investment allows you to gradually increase your capital as your confidence and knowledge grow. As you gain experience and witness the outcomes of your initial investments, you can reassess your risk appetite and make informed decisions about allocating more funds to your portfolio. This incremental approach helps you build a solid investment strategy over time, ensuring better control and minimizing potential losses.

In conclusion, starting with a small investment is a prudent approach for beginners in the world of investing. It provides an opportunity to learn, understand market dynamics, and gain experience without exposing oneself to excessive risks. By beginning with a comfortable amount, diversifying your investments, and gradually increasing your capital, you can develop a robust investment strategy while safeguarding your financial well-being. Remember, investing is a journey, and starting small is the first step towards long-term success.