Begin by educating yourself about cryptocurrencies, blockchain technology, and the basics of investing. In today’s digital age, cryptocurrencies have become a popular topic of discussion and an emerging asset class. To navigate this complex landscape, it is crucial to arm yourself with knowledge. Start by understanding the fundamentals, including how cryptocurrencies work, the underlying technology called blockchain, and the potential benefits and risks associated with investing in this space.

Begin by educating yourself about cryptocurrencies, blockchain technology, and the basics of investing. In today’s digital age, cryptocurrencies have become a popular topic of discussion and an emerging asset class. To navigate this complex landscape, it is crucial to arm yourself with knowledge. Start by understanding the fundamentals, including how cryptocurrencies work, the underlying technology called blockchain, and the potential benefits and risks associated with investing in this space.

One essential aspect of cryptocurrency education is familiarizing yourself with key terms and concepts. For instance, wallets play a vital role in securely storing and managing your digital assets. A wallet is essentially a software application or hardware device that allows you to securely store, send, and receive cryptocurrencies. Understanding the different types of wallets available, such as hot wallets (connected to the internet) or cold wallets (offline storage), can help you choose the right option for your needs.

Another essential concept to grasp is that of exchanges. Cryptocurrency exchanges serve as digital marketplaces where you can buy, sell, and trade various cryptocurrencies using traditional currencies, such as the US dollar or Euro. Research different exchanges to find one that is reputable, secure, and offers a wide variety of cryptocurrencies for trading.

It is also important to understand the concept of public and private keys. Public keys serve as unique identifiers for your cryptocurrency transactions, while private keys are secret codes used to authenticate and authorize transactions. By understanding the role of public and private keys, you can better protect your digital assets and ensure secure transactions.

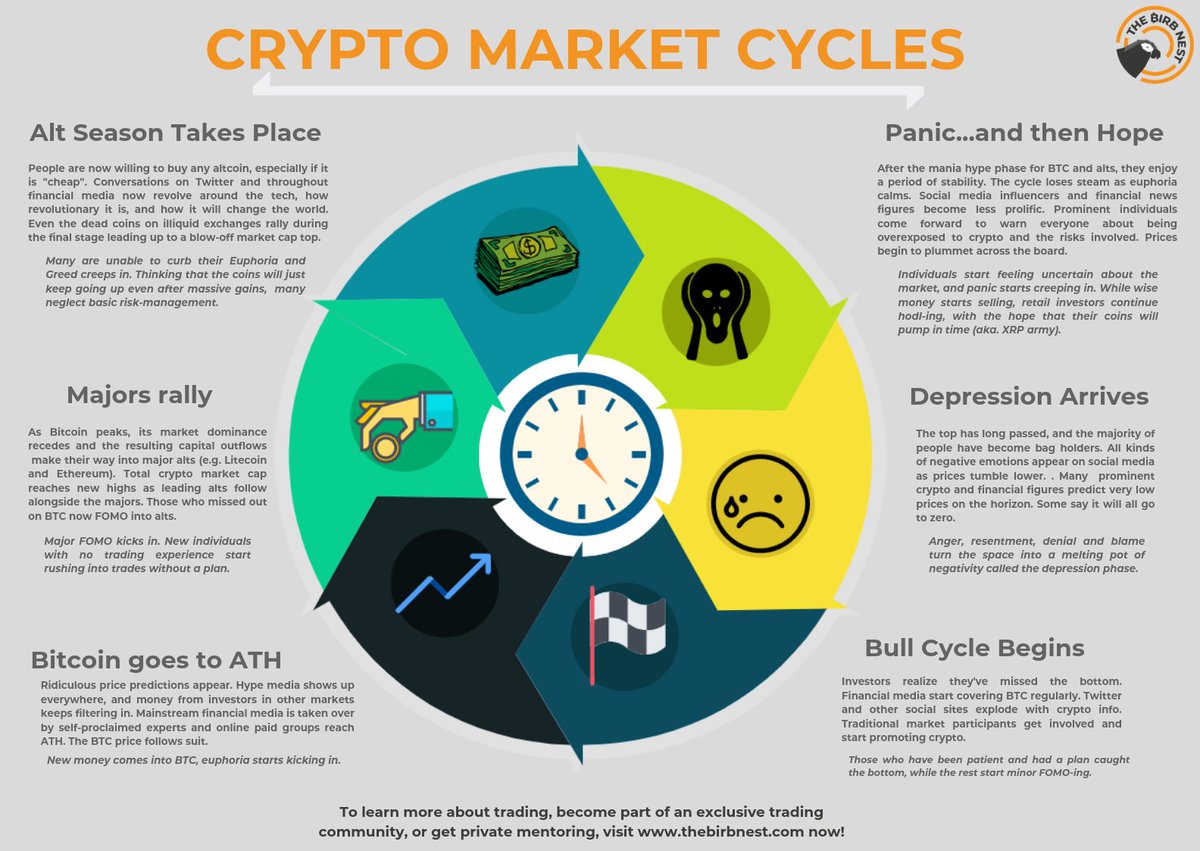

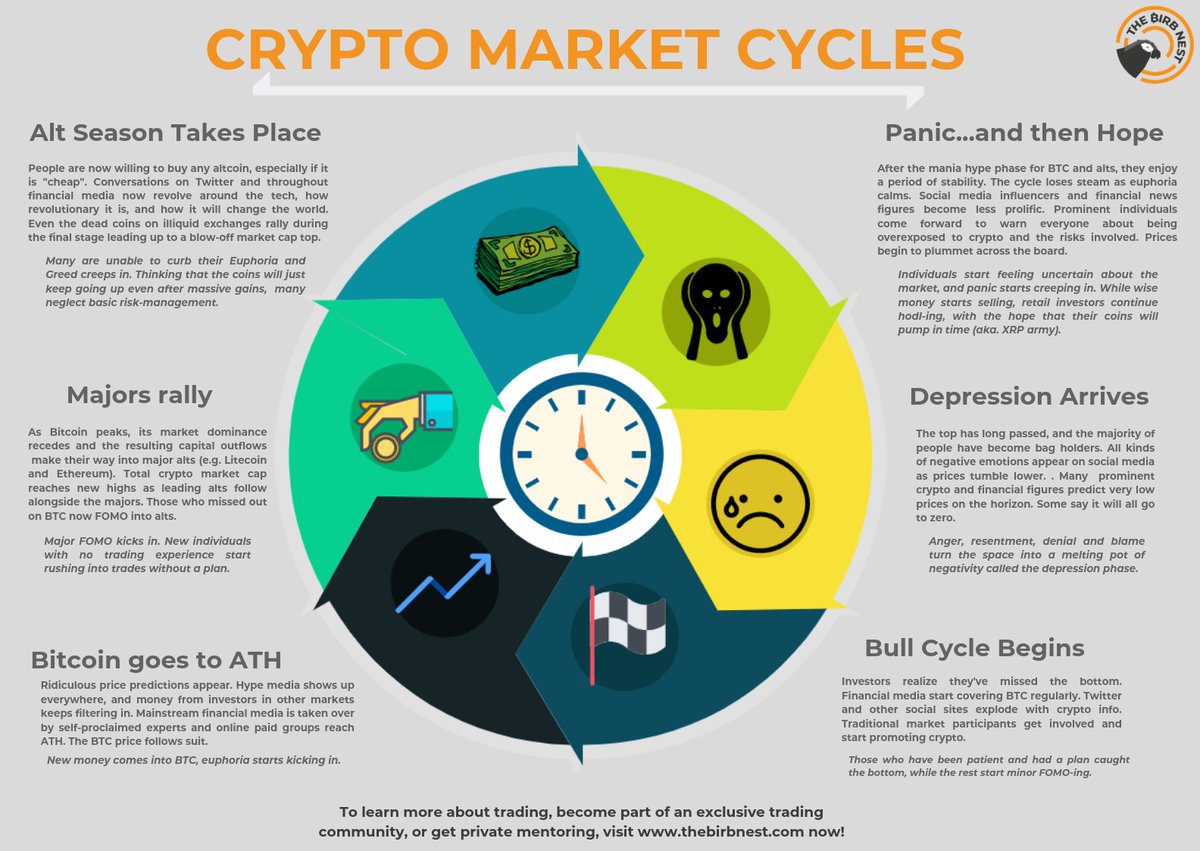

Furthermore, stay updated with industry news and trends. The cryptocurrency space is fast-paced and ever-evolving, with new projects and developments constantly emerging. By following reputable news sources, subscribing to industry newsletters, and joining online communities, you can stay informed about the latest advancements, regulations, and market trends. This knowledge will help you make more informed decisions and stay ahead of the curve.

Remember, investing in cryptocurrencies involves risks, and the market can be highly volatile. Educating yourself about the industry can help mitigate some of these risks and increase your chances of making informed investment decisions. Start by dedicating time to learn the basics, familiarize yourself with key terms and concepts, and keep abreast of industry news and trends. By doing so, you will be better equipped to navigate the world of cryptocurrencies and capitalize on the opportunities this exciting asset class offers.

When it comes to delving into the world of cryptocurrencies, one of the first steps you need to take is choosing a reliable exchange and setting up a secure digital wallet. These two components are essential for safely buying, selling, and storing your cryptocurrencies. In this article, we will discuss the importance of selecting a reputable cryptocurrency exchange and setting up a secure digital wallet.

To begin your cryptocurrency journey, it is crucial to research and select a reputable cryptocurrency exchange that suits your needs. With numerous exchanges available, it’s important to consider several factors before making a decision. First and foremost, prioritize security measures. Look for exchanges that employ robust security protocols, such as two-factor authentication, encryption, and cold storage for funds. Ensuring your funds are protected from potential threats should be a top priority.

User-friendliness is another factor to take into account. Look for exchanges with intuitive interfaces and user-friendly platforms. This will make it easier for you to navigate through the exchange, execute trades, and monitor your investments. A user-friendly exchange can significantly enhance your overall experience and make it more convenient to manage your cryptocurrencies.

Consider the range of cryptocurrencies offered by the exchange. Some exchanges may offer a limited selection, while others have a wide variety of cryptocurrencies to choose from. If you have specific cryptocurrencies in mind that you want to trade or invest in, make sure the exchange supports them. Moreover, keep an eye on the fees charged by the exchange. Different exchanges have different fee structures, including transaction fees, deposit fees, and withdrawal fees. Compare the fees across different exchanges to find the one that offers competitive rates.

Customer support is another crucial aspect to consider. Look for exchanges that provide responsive and reliable customer support. In case you encounter any issues or have questions, having access to a helpful support team can make a significant difference. Prompt assistance can help resolve problems quickly and ensure a smooth trading experience.

In addition to selecting a reliable exchange, it is essential to set up a secure digital wallet to store your cryptocurrencies. A digital wallet acts as a secure repository for your cryptocurrencies, protecting them from potential security breaches. Look for wallets that offer strong encryption and backup options. Hardware wallets, such as Ledger or Trezor, are considered one of the most secure options available. They store your private keys offline, away from potential online threats.

Remember to follow best practices for wallet security by enabling two-factor authentication and regularly updating your wallet software. Additionally, consider using a backup solution to prevent the loss of your private keys. By taking these precautions, you can ensure the safety and security of your cryptocurrencies.

In conclusion, when venturing into the world of cryptocurrencies, it is crucial to choose a reliable exchange and set up a secure digital wallet. Take the time to research and select an exchange that aligns with your needs and priorities. Consider factors such as security measures, user-friendliness, available cryptocurrencies, fees, and customer support. Additionally, prioritize setting up a secure digital wallet to store your cryptocurrencies safely. By taking these steps, you can embark on your cryptocurrency journey with confidence and peace of mind.

When it comes to delving into the world of cryptocurrencies, one of the first steps you need to take is choosing a reliable exchange and setting up a secure digital wallet. These two components are essential for safely buying, selling, and storing your cryptocurrencies. In this article, we will discuss the importance of selecting a reputable cryptocurrency exchange and setting up a secure digital wallet.

To begin your cryptocurrency journey, it is crucial to research and select a reputable cryptocurrency exchange that suits your needs. With numerous exchanges available, it’s important to consider several factors before making a decision. First and foremost, prioritize security measures. Look for exchanges that employ robust security protocols, such as two-factor authentication, encryption, and cold storage for funds. Ensuring your funds are protected from potential threats should be a top priority.

User-friendliness is another factor to take into account. Look for exchanges with intuitive interfaces and user-friendly platforms. This will make it easier for you to navigate through the exchange, execute trades, and monitor your investments. A user-friendly exchange can significantly enhance your overall experience and make it more convenient to manage your cryptocurrencies.

Consider the range of cryptocurrencies offered by the exchange. Some exchanges may offer a limited selection, while others have a wide variety of cryptocurrencies to choose from. If you have specific cryptocurrencies in mind that you want to trade or invest in, make sure the exchange supports them. Moreover, keep an eye on the fees charged by the exchange. Different exchanges have different fee structures, including transaction fees, deposit fees, and withdrawal fees. Compare the fees across different exchanges to find the one that offers competitive rates.

Customer support is another crucial aspect to consider. Look for exchanges that provide responsive and reliable customer support. In case you encounter any issues or have questions, having access to a helpful support team can make a significant difference. Prompt assistance can help resolve problems quickly and ensure a smooth trading experience.

In addition to selecting a reliable exchange, it is essential to set up a secure digital wallet to store your cryptocurrencies. A digital wallet acts as a secure repository for your cryptocurrencies, protecting them from potential security breaches. Look for wallets that offer strong encryption and backup options. Hardware wallets, such as Ledger or Trezor, are considered one of the most secure options available. They store your private keys offline, away from potential online threats.

Remember to follow best practices for wallet security by enabling two-factor authentication and regularly updating your wallet software. Additionally, consider using a backup solution to prevent the loss of your private keys. By taking these precautions, you can ensure the safety and security of your cryptocurrencies.

In conclusion, when venturing into the world of cryptocurrencies, it is crucial to choose a reliable exchange and set up a secure digital wallet. Take the time to research and select an exchange that aligns with your needs and priorities. Consider factors such as security measures, user-friendliness, available cryptocurrencies, fees, and customer support. Additionally, prioritize setting up a secure digital wallet to store your cryptocurrencies safely. By taking these steps, you can embark on your cryptocurrency journey with confidence and peace of mind.

Start with a small investment: It’s always wise for beginners to dip their toes into the investment world with a small investment. It allows you to test the waters without risking a significant amount of money. Starting with an amount that you are comfortable potentially losing is a precautionary measure that helps manage your expectations and minimize any possible financial setbacks. By beginning with a small investment, you can gain valuable experience and insights into market dynamics. You’ll have the opportunity to observe how different assets perform, understand the fluctuations of the market, and learn from any mistakes you might make along the way.

When you start small, you can also take the time to explore different investment options. This includes researching various asset classes such as stocks, bonds, mutual funds, or real estate. Each asset class carries its own level of risk and potential return on investment. By starting with a smaller investment, you can diversify your portfolio and test different investment strategies. This way, you can find the approach that suits your risk tolerance and financial goals.

One of the benefits of starting with a small investment is the ability to gradually increase your investment as you gain confidence and knowledge. As you learn more about investing and become comfortable with the market, you can explore opportunities to expand your portfolio. By starting small, you have the flexibility to adjust your investment strategy over time based on market conditions and your own financial situation. It allows you to build a foundation of investment skills and principles that will guide you as you progress along your investment journey.

Starting with a small investment also helps to manage emotions that can often influence investment decisions. It can be easy to get carried away by the excitement of the market or swayed by short-term fluctuations. However, by starting with a small amount, you can develop a disciplined approach to investing and mitigate the risk of making impulsive decisions. This mindset of patience and rationality will serve you well in the long run and prevent you from succumbing to the temptation of chasing quick gains or panicking during market downturns.

In conclusion, starting with a small investment is a prudent way for beginners to enter the world of investing. It allows you to gain experience, understand market dynamics, and gradually increase your investment as you become more confident. By starting small, you can diversify your portfolio, explore different investment options, and build a foundation of investment skills. Moreover, starting with a small investment helps manage emotions and develop a disciplined approach to investing. So, if you’re new to investing, don’t be afraid to start small and embark on your investment journey with cautious optimism.

Implementing a Strategy and Practicing Risk Management

When it comes to trading or investing, it’s crucial to have a well-defined strategy in place. A strategy serves as a roadmap, guiding your decisions and actions in the market. Start by identifying your goals and understanding your risk tolerance. This will help you develop a strategy that aligns with your financial objectives and ensures you’re comfortable with the level of risk involved.

One important aspect of any strategy is diversification. By spreading your investments across different asset classes, sectors, and regions, you can mitigate the risk associated with any single investment. Diversification helps you avoid putting all your eggs in one basket, reducing the impact of potential losses.

In addition to diversification, employing risk management techniques is essential. One such technique is the use of stop-loss orders. These orders automatically sell a security when it reaches a predetermined price, limiting your potential losses. By setting stop-loss orders, you create an exit strategy that protects your capital and prevents significant downturns in your portfolio.

Another critical aspect of risk management is maintaining discipline. It’s easy to get carried away by short-term market fluctuations and make impulsive decisions. However, a disciplined approach involves sticking to your strategy and avoiding knee-jerk reactions. Focus on the long-term goals of your investments rather than being swayed by temporary market movements.

Furthermore, it’s vital to invest only what you can afford to lose. While investing can offer lucrative opportunities, there is always a level of risk involved. Be realistic about your financial situation and consider the potential consequences of any losses. By investing an amount you can afford to lose, you protect yourself from significant financial setbacks.

Additionally, staying updated on market trends and conducting thorough research is crucial. Market conditions can change rapidly, and being well-informed allows you to make informed decisions. Keep track of relevant news, economic indicators, and any factors that may affect your investments. This knowledge will help you adapt your strategy and make necessary adjustments to your portfolio.

In conclusion, implementing a strategy and practicing risk management are vital for successful trading or investing. Develop a strategy that aligns with your goals and risk tolerance, and consider diversifying your portfolio to minimize risk. Utilize risk management techniques such as stop-loss orders to limit potential losses, and maintain discipline by avoiding impulsive decisions. Invest only what you can afford to lose and stay updated on market trends. By following these practices, you can enhance your chances of achieving your financial objectives while mitigating unnecessary risk.