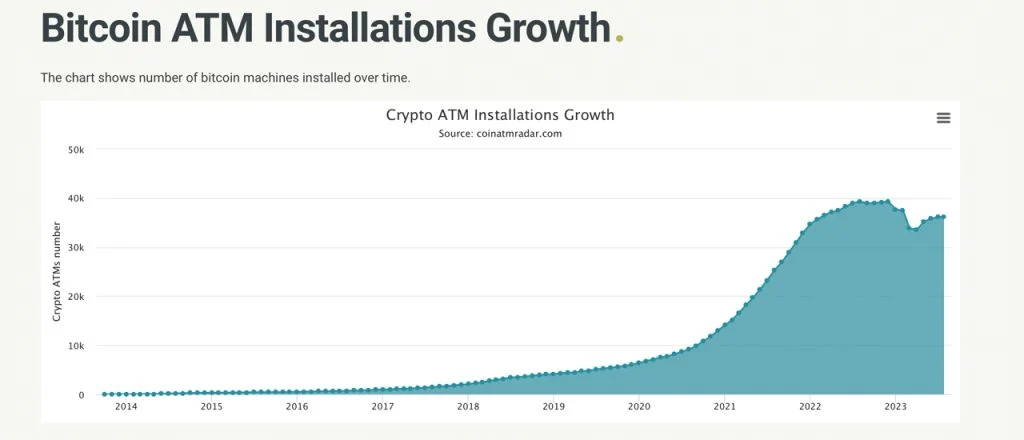

The Continued Rise of Bitcoin

The Continued Rise of Bitcoin

Bitcoin, the world’s first and most well-known cryptocurrency, has been making headlines for over a decade now. With its decentralized nature and limited supply, Bitcoin has captured the attention of investors, traders, and even governments. As we move into 2023, it is crucial to discuss the current state of Bitcoin and its potential for further growth.

One of the key factors driving Bitcoin’s upward trajectory is increased institutional adoption. Over the past few years, we have witnessed major financial institutions and corporations pouring billions of dollars into Bitcoin. This institutional interest has not only brought legitimacy to the cryptocurrency market but has also contributed to its overall value. The influx of institutional funds has created a sense of confidence among retail investors, further bolstering Bitcoin’s popularity.

Additionally, regulatory developments play a vital role in shaping Bitcoin’s future. Governments around the world are gradually recognizing the importance of cryptocurrencies and are working towards implementing comprehensive regulations. While some countries have embraced Bitcoin with open arms, others have taken a more cautious approach. However, as regulations become clearer and more accommodating, Bitcoin is likely to experience a surge in mainstream adoption. This regulatory clarity will provide a secure environment for investors and encourage more individuals to explore the potential of Bitcoin.

Technological advancements also contribute to Bitcoin’s growth potential. The underlying technology of Bitcoin, blockchain, has revolutionized various industries, including finance, supply chain management, and healthcare. As blockchain technology continues to evolve, the possibilities for Bitcoin’s application and scalability are endless. With improvements in transaction speed, security, and scalability, Bitcoin can potentially become a mainstream method of payment and revolutionize the financial landscape.

Furthermore, the COVID-19 pandemic has played a significant role in accelerating Bitcoin’s rise. As traditional financial systems faced disruptions and economic uncertainties loomed, individuals and institutions turned to Bitcoin as a hedge against inflation and a store of value. This widespread adoption during challenging times has further solidified Bitcoin’s position as a safe-haven asset.

In conclusion, the future of Bitcoin appears promising. Increased institutional adoption, regulatory developments, and technological advancements are driving its value and popularity. As more financial institutions and corporations embrace Bitcoin, it gains further legitimacy and attracts more retail investors. Clearer regulations provide a secure environment for investors, fostering mainstream adoption. Technological advancements, especially in blockchain technology, enhance Bitcoin’s capabilities and potential applications. Lastly, the global pandemic has highlighted Bitcoin’s role as a safe-haven asset. With these factors combined, Bitcoin is poised for continued growth and may play a significant role in shaping the future of finance in 2023.

NFTs and the Digital Art Revolution: Explore the rise of non-fungible tokens (NFTs) and their impact on the art world and beyond. Discuss the growing interest in digital art and collectibles, the role of NFTs in facilitating ownership and provenance, and the potential for NFTs to disrupt traditional art marketplaces and empower artists.

The art world has always been a realm of creativity and imagination, but in recent years, it has witnessed a revolution fueled by non-fungible tokens (NFTs). NFTs, which are unique digital assets stored on blockchain technology, have taken the art world by storm, opening up new possibilities and challenges. The growing interest in digital art and collectibles has been one of the driving forces behind this revolution.

Digital art, once considered a niche form of expression, has now gained mainstream recognition and appreciation. Artists are now exploring the endless possibilities offered by digital mediums, pushing the boundaries of traditional art forms. With the advent of social media and online galleries, digital artists have found a platform to showcase their work to a global audience, fostering a vibrant and inclusive art community.

NFTs have emerged as a game-changer in the art world, allowing artists to establish ownership and provenance in a way that was previously impossible. By tokenizing their artwork, artists can create a unique digital asset that can be bought, sold, and owned by collectors. This not only provides artists with a new stream of income but also ensures that their work retains its value, even in the digital realm.

Moreover, NFTs have the potential to disrupt traditional art marketplaces. By eliminating intermediaries such as galleries and auction houses, artists can directly connect with their audience and sell their artwork. This decentralized approach empowers artists, giving them more control over their creative output and financial independence. It also opens up opportunities for emerging artists who may have struggled to break into the traditional art world.

While NFTs offer exciting possibilities, they have also raised concerns about sustainability and the environmental impact of blockchain technology. The energy consumption required for minting and trading NFTs has sparked debates about the carbon footprint associated with digital art. As the art world grapples with these challenges, it is essential to find sustainable solutions that balance the innovation and potential of NFTs with environmental responsibility.

In conclusion, the rise of NFTs has transformed the art world, providing artists with new avenues for expression and financial success. The growing interest in digital art and collectibles has sparked a revolution that challenges traditional notions of ownership and provenance. While there are challenges to be addressed, the potential of NFTs to disrupt traditional art marketplaces and empower artists cannot be ignored. As we navigate this new era of digital art, finding a balance between innovation and sustainability will be paramount.

The future of decentralized finance (DeFi) is a topic that has gained significant attention in recent years. As traditional financial systems continue to face criticism for their centralized nature and lack of accessibility, DeFi protocols have emerged as a potential solution. These protocols leverage blockchain technology to create a decentralized and open financial ecosystem that is available to anyone with an internet connection.

One of the key benefits of DeFi is increased accessibility. Unlike traditional financial systems that require individuals to go through intermediaries such as banks, DeFi allows users to access financial services directly from their wallets. This opens up opportunities for individuals who are unbanked or underbanked, providing them with access to a wide range of financial services, such as loans and savings accounts.

Moreover, DeFi has the potential to foster financial inclusion. In many parts of the world, individuals are excluded from traditional financial systems due to various reasons, such as lack of documentation or credit history. DeFi protocols, on the other hand, do not discriminate based on these factors. As long as individuals have access to the internet, they can participate in DeFi and access the same financial services as anyone else.

However, with the benefits come risks. Security is one of the major challenges associated with DeFi. While blockchain technology provides a high level of security, DeFi protocols are not immune to hacks and vulnerabilities. Several high-profile DeFi hacks have already occurred, resulting in significant losses for users. As the industry continues to grow, it is crucial for developers and users to prioritize security measures and conduct thorough audits of smart contracts to minimize the risks.

Regulation is another challenge that DeFi faces. As DeFi protocols operate in a decentralized manner, it becomes difficult for regulators to oversee and enforce compliance. This lack of regulation can potentially expose users to fraudulent schemes and scams. However, it is important to note that some jurisdictions are working towards implementing regulatory frameworks for DeFi to protect users and ensure the stability of the financial system.

Beyond lending and borrowing, DeFi has the potential to revolutionize various other sectors. Decentralized exchanges allow users to trade cryptocurrencies directly with each other, eliminating the need for intermediaries. Yield farming enables users to earn passive income by providing liquidity to DeFi protocols. Insurance protocols are also being developed to provide coverage against smart contract failures or other unforeseen events.

In conclusion, the future of decentralized finance looks promising. With its potential to increase accessibility, promote financial inclusion, and revolutionize various sectors, DeFi has the power to reshape the traditional financial industry. However, it is crucial to address the challenges of security and regulation to ensure the long-term success and sustainability of the DeFi ecosystem.