Understanding the Basics of Bitcoin and the US Dollar

Understanding the Basics of Bitcoin and the US Dollar

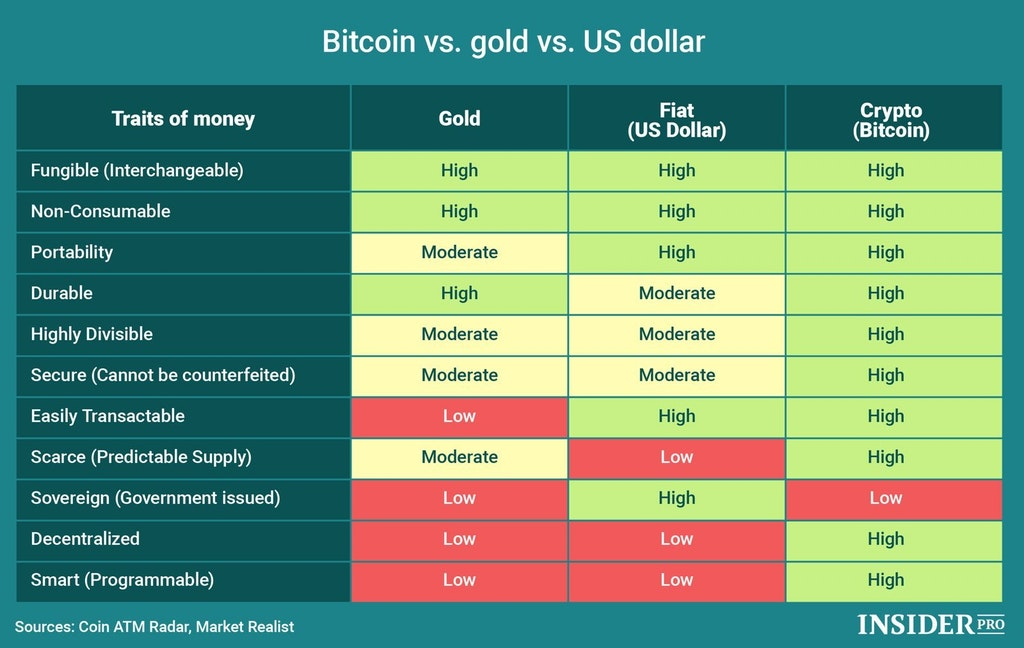

Bitcoin and the US Dollar are two of the most widely recognized forms of currency in the world today. While the US Dollar is a traditional fiat currency issued and regulated by the government, Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. In this article, we will explore the basics of both Bitcoin and the US Dollar, and how they differ in terms of issuance, value, and usage.

The US Dollar, as mentioned earlier, is a fiat currency. This means that it is not backed by a physical commodity like gold or silver but rather by the trust and confidence of the people who use it. The US government has the authority to issue and regulate the supply of US Dollars, which is typically done through the Federal Reserve System. The value of the US Dollar is determined by various factors such as interest rates, inflation, and the overall health of the economy.

On the other hand, Bitcoin is a form of cryptocurrency that was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, Bitcoin is not issued or regulated by any central authority. Instead, it operates on a decentralized network called the blockchain, which is maintained by a network of computers around the world. Bitcoin is created through a process called mining, where powerful computers solve complex mathematical problems to validate and record transactions on the blockchain.

The supply of Bitcoin is limited to 21 million, which means that there will never be more than that number of Bitcoins in existence. This scarcity is one of the factors that contribute to the value of Bitcoin. Additionally, the value of Bitcoin is determined by supply and demand dynamics in the market. As more people adopt Bitcoin and use it for various purposes, its value can increase. However, it is worth noting that the price of Bitcoin can be highly volatile and subject to significant fluctuations.

While the US Dollar is widely accepted as legal tender for goods and services in the United States and many other countries, Bitcoin’s acceptance is still limited. However, over the years, Bitcoin has gained popularity and has been increasingly adopted by individuals and businesses as a form of payment. Some online retailers and service providers now accept Bitcoin as a means of payment, and there are even Bitcoin ATMs in some cities.

In conclusion, both Bitcoin and the US Dollar have their own unique features and characteristics. The US Dollar is a traditional fiat currency issued by the government, while Bitcoin is a decentralized digital currency. The value and usage of these currencies differ, with the US Dollar being widely accepted and regulated by the government, and Bitcoin gaining traction as a decentralized alternative. As the world continues to evolve digitally, it will be interesting to see how these currencies coexist and shape the future of finance.

Analyzing the Volatility and Stability of Bitcoin and the US Dollar

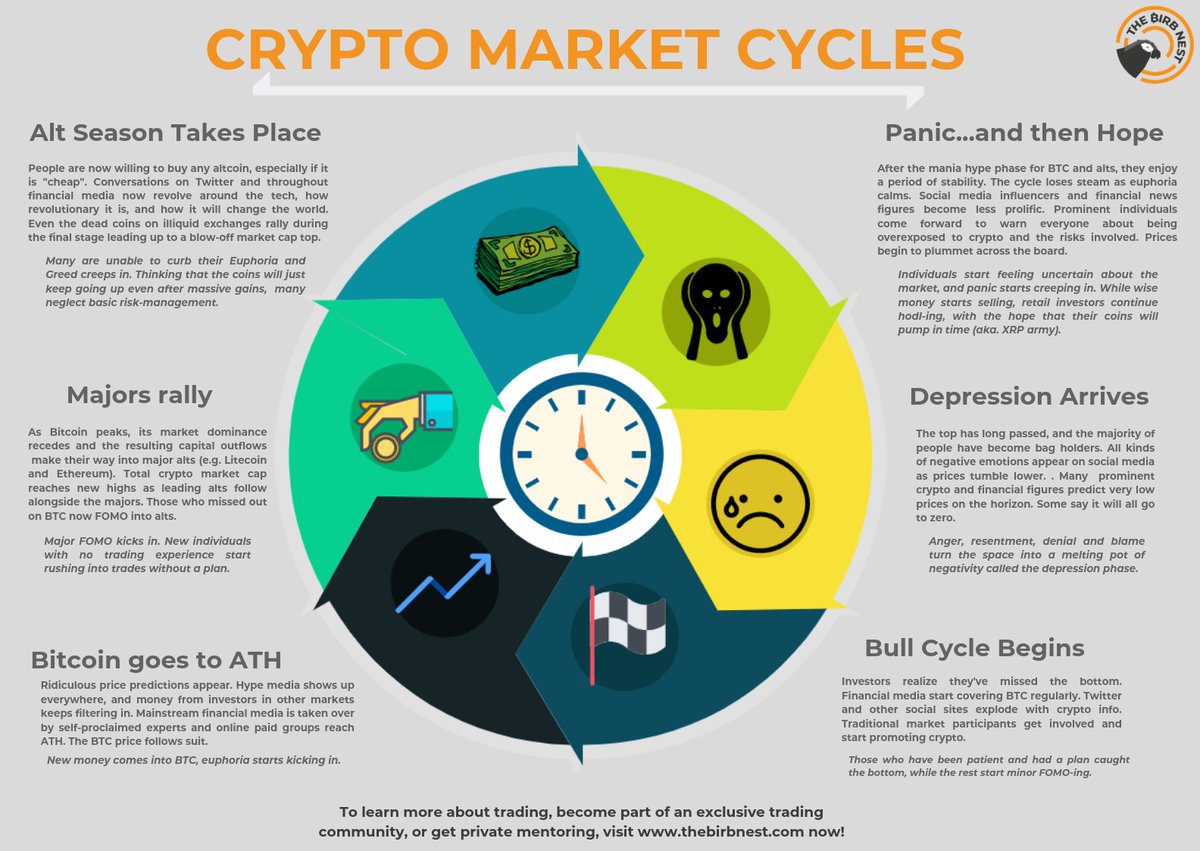

Cryptocurrencies have undoubtedly gained significant attention and popularity in recent years, with Bitcoin taking the lead as the most well-known and widely used digital currency. However, as the value of Bitcoin continues to fluctuate wildly, it becomes crucial to examine its volatility and stability in comparison to traditional currencies like the US Dollar. This article aims to shed light on the factors that contribute to the volatility of Bitcoin and the stability of the US Dollar, providing readers with a better understanding of these two financial systems.

Bitcoin’s volatility can be attributed to several key factors. Firstly, the limited supply of Bitcoin plays a significant role in its price fluctuations. With a maximum supply cap of 21 million coins, any changes in demand can lead to drastic price swings. Additionally, the absence of a central authority or regulatory body governing Bitcoin’s value exposes it to market sentiment and speculation, further contributing to its volatility. Moreover, the relatively smaller market size compared to traditional financial markets makes Bitcoin vulnerable to sudden price movements caused by large trades or market manipulation.

On the other hand, the US Dollar, as the world’s reserve currency, benefits from its stability due to various factors. One primary factor is the strong and well-established economic system of the United States. The stability of the US economy provides investors with confidence in the value and reliability of the US Dollar. Furthermore, the US Federal Reserve’s ability to adjust interest rates and implement monetary policies allows for better control over inflation and stabilizes the currency. These factors combine to ensure that the US Dollar remains relatively stable compared to digital currencies like Bitcoin.

While Bitcoin’s volatility may be seen as a drawback, it also presents opportunities for investors. The potential for substantial gains attracts many who are willing to take the risk of investing in a digital currency. However, it is crucial to note that these gains come with an equal level of risk. The extreme price volatility of Bitcoin can lead to significant losses as well. In contrast, the stability of the US Dollar provides a sense of security for those who prefer conservative investments with a lower risk profile.

In conclusion, the volatility of Bitcoin and the stability of the US Dollar are two contrasting aspects of the financial world. Bitcoin’s limited supply, absence of centralized control, and relatively small market size contribute to its price volatility. On the other hand, the stability of the US Dollar is anchored by the strength of the US economy and the ability of the Federal Reserve to implement effective monetary policies. Understanding the factors that influence the volatility and stability of these two currencies is essential for investors and individuals seeking to navigate the complexities of the financial landscape. Whether one chooses to embrace the risks and potential gains of Bitcoin or opt for the stability and security of the US Dollar, both offer unique opportunities and considerations in today’s ever-evolving world of finance.

Bitcoin and the US Dollar are two widely recognized currencies that have gained significant attention in recent years. In this article, we will examine their market cap, liquidity, and adoption to shed light on their current status in the financial world.

Market cap is a key indicator of the overall value and importance of a currency. Bitcoin, often referred to as digital gold, has experienced a tremendous surge in market cap over the years. As of now, its market cap stands at around $1 trillion, making it the largest cryptocurrency by market capitalization. On the other hand, the US Dollar boasts a staggering market cap of over $23 trillion, making it the most widely used and accepted currency in the world.

Liquidity is another crucial aspect to consider when analyzing the potential of a currency. Bitcoin, being a decentralized digital currency, is traded on various cryptocurrency exchanges globally. This widespread availability and accessibility contribute to its liquidity. However, due to its relatively low adoption compared to traditional currencies, Bitcoin’s liquidity is still somewhat limited. On the contrary, the US Dollar’s liquidity is unparalleled. It is widely accepted and used in international trade, making it highly liquid and easily convertible.

Adoption plays a vital role in determining the future of a currency. Bitcoin has witnessed a significant surge in adoption in recent years. Numerous businesses, including major corporations, now accept Bitcoin as a form of payment. Additionally, more individuals are investing in Bitcoin as a store of value or as a hedge against traditional currencies. However, despite its growing adoption, Bitcoin is still far from achieving mainstream status compared to the US Dollar. The US Dollar is accepted worldwide and is the primary currency for international transactions. Its widespread adoption ensures its stability and dominance in the global financial system.

While Bitcoin has made significant progress in terms of market cap and adoption, it still has a long way to go to rival the US Dollar. The US Dollar’s market cap and liquidity are unmatched, solidifying its position as the world’s leading currency. Bitcoin’s decentralized nature and potential for growth make it an attractive investment option for many. However, it is crucial to remember that the US Dollar remains the backbone of the global financial system.

In conclusion, examining the market cap, liquidity, and adoption of Bitcoin and the US Dollar highlights their contrasting positions in the financial world. Bitcoin’s market cap and adoption have seen remarkable growth, but it still falls short compared to the US Dollar. While Bitcoin offers potential as a decentralized digital currency, the US Dollar’s widespread acceptance and stability make it the dominant currency globally.

Evaluating the Investment Potential and Risks of Bitcoin and the US Dollar

When it comes to evaluating investment potential, Bitcoin and the US Dollar are two prominent players in the financial world. Both offer unique opportunities and carry their fair share of risks. Understanding these factors is essential for investors looking to make informed decisions in their pursuit of financial growth.

Bitcoin, a decentralized digital currency, has gained significant attention in recent years. Its potential for high returns has attracted many investors, while its volatile nature has left others wary. One of the key advantages of Bitcoin is its limited supply, which sets it apart from fiat currencies like the US Dollar. This scarcity has led to a surge in value, making it an attractive option for those seeking long-term investment gains.

However, the inherent volatility of Bitcoin cannot be ignored. The cryptocurrency market is highly unpredictable, with rapid price fluctuations that can lead to substantial gains or losses. This unpredictability poses a significant risk for investors. Additionally, Bitcoin’s lack of regulation and its susceptibility to hacking and fraud also make it a risky investment option.

On the other hand, the US Dollar is considered a more stable and established form of currency. As the global reserve currency, the US Dollar is widely accepted and used in international trade. Its stability is backed by the robust economy of the United States and the country’s commitment to maintaining its value. These factors make the US Dollar a relatively safe investment option.

Yet, the US Dollar is not without risks. Inflation is a concern that can erode the value of the currency over time. The policies of the Federal Reserve, the central banking system of the United States, also play a significant role in influencing the value of the US Dollar. Changes in interest rates and monetary policies can create volatility in the currency market and impact the value of investments.

In conclusion, evaluating the investment potential and risks of Bitcoin and the US Dollar is crucial for investors seeking to diversify their portfolios. Bitcoin offers the potential for high returns, driven by its scarcity and growing acceptance. However, its volatility and lack of regulation pose significant risks. On the other hand, the US Dollar provides stability and widespread acceptance, but factors like inflation and monetary policy can impact its value. Ultimately, investors must carefully consider their risk appetite and financial goals before making investment decisions involving Bitcoin or the US Dollar.

With the uncertain economic landscape and increasing digitization, the future of currencies is a hot topic of discussion. One currency that has been capturing the attention of investors and financial experts alike is Bitcoin. This digital currency, often referred to as cryptocurrency, has seen tremendous growth and volatility in recent years. At the same time, the US Dollar, as the world’s reserve currency, continues to play a crucial role in global trade and finance. In this article, we will delve into the future outlook and potential of both Bitcoin and the US Dollar, examining their strengths, weaknesses, and the potential impact they may have on the global financial system.

Bitcoin, created in 2009, has come a long way from its humble beginnings. It operates on a decentralized network known as blockchain, which ensures transparency and security in transactions. Proponents argue that Bitcoin’s limited supply (capped at 21 million coins) makes it a valuable asset that can serve as a hedge against inflation. Furthermore, its ability to function anonymously and its borderless nature make it an attractive option for individuals seeking financial autonomy. However, Bitcoin’s volatility has been a cause for concern. Its price fluctuations can be substantial, making it a risky investment. Additionally, the lack of regulations and widespread acceptance can hinder its mainstream adoption.

On the other hand, the US Dollar has been the dominant global currency for decades. Its status as the world’s reserve currency provides it with stability and widespread acceptance. The US Dollar’s strength lies in the strong and stable economy of the United States and the trust it has garnered from investors and countries worldwide. Moreover, the Federal Reserve’s ability to manage monetary policy and influence interest rates gives the US Dollar an edge. However, the US Dollar is not without its challenges. The immense debt levels, political uncertainties, and the potential effects of global economic shifts may impact its long-term stability and standing.

Looking ahead, the future of Bitcoin remains uncertain. While it has gained traction as a speculative investment and a store of value, it is still far from becoming a mainstream currency. The regulatory landscape around Bitcoin is evolving, and governments worldwide are exploring its potential risks and benefits. If Bitcoin can overcome these challenges and establish itself as a reliable and widely accepted currency, it has the potential to revolutionize the financial world.

As for the US Dollar, its future is also at a crossroads. The rise of new economic powers, such as China, and the increasing digitization of finance pose challenges to its dominance. Additionally, the global economic fallout from the COVID-19 pandemic has raised questions about the US Dollar’s resilience. However, the US Dollar’s long-standing position as the world’s reserve currency and the stability of the US economy provide a strong foundation. The Federal Reserve’s response to economic crises and its adaptability to changing circumstances will play a crucial role in determining the future trajectory of the US Dollar.

In conclusion, the future outlook and potential of Bitcoin and the US Dollar present intriguing possibilities. While Bitcoin offers decentralization and financial autonomy, its volatility and lack of regulatory framework remain obstacles. On the other hand, the US Dollar’s stability and global acceptance come with potential challenges in an evolving economic landscape. As we venture into the future, only time will tell which currency will shape the financial landscape and emerge as a dominant force.