The importance of financial knowledge for startup founders cannot be overstated. In the context of starting and running a successful startup, understanding financial concepts is crucial. By having a firm grasp on budgeting, cash flow management, and financial analysis, founders can make informed decisions and effectively navigate the complexities of entrepreneurship.

The importance of financial knowledge for startup founders cannot be overstated. In the context of starting and running a successful startup, understanding financial concepts is crucial. By having a firm grasp on budgeting, cash flow management, and financial analysis, founders can make informed decisions and effectively navigate the complexities of entrepreneurship.

Budgeting is a fundamental aspect of financial management for startups. It involves creating a plan that outlines projected income and expenses, allowing founders to allocate resources wisely. With a well-defined budget, founders can prioritize their spending, identify areas of potential cost savings, and ensure that they are operating within their means. By monitoring and adjusting the budget as necessary, founders can maintain financial stability and avoid unnecessary financial risks.

Cash flow management is another vital financial skill for startup founders. It involves monitoring the inflow and outflow of cash in the business, ensuring that there is enough liquidity to meet day-to-day expenses. A strong understanding of cash flow allows founders to anticipate and plan for any potential cash shortages, such as seasonal fluctuations or unexpected expenses. By effectively managing cash flow, founders can avoid cash flow problems that could potentially cripple their business.

Financial analysis is a powerful tool that enables founders to assess the financial health of their startup and make informed decisions. By analyzing financial statements, founders can gain insights into their company’s profitability, performance, and growth potential. Understanding financial ratios and trends allows founders to identify areas of strength and weakness, enabling them to make strategic decisions to maximize profitability and mitigate risks. Financial analysis also helps founders communicate their startup’s financial health to potential investors, partners, and stakeholders, enhancing credibility and attracting necessary funding.

Moreover, financial knowledge empowers founders to evaluate investment opportunities and make sound financial decisions. Whether it’s deciding on the most cost-effective marketing strategy, assessing the feasibility of expanding into a new market, or weighing the pros and cons of securing external funding, understanding financial concepts enables founders to evaluate the financial implications of their choices and make informed decisions that align with their business objectives.

In conclusion, possessing financial knowledge is vital for startup founders. By understanding budgeting, cash flow management, and financial analysis, founders can make informed decisions, effectively manage their startup’s finances, and navigate the intricate landscape of entrepreneurship. Financial knowledge not only enhances the chances of success for startups but also enables founders to build a solid foundation for long-term growth and sustainability.

Building a strong financial foundation is crucial for the success of any startup. Founders must prioritize acquiring important financial knowledge to ensure the long-term viability of their businesses. This article aims to outline the key aspects of financial knowledge that founders should focus on, while emphasizing the significance of creating a robust financial plan.

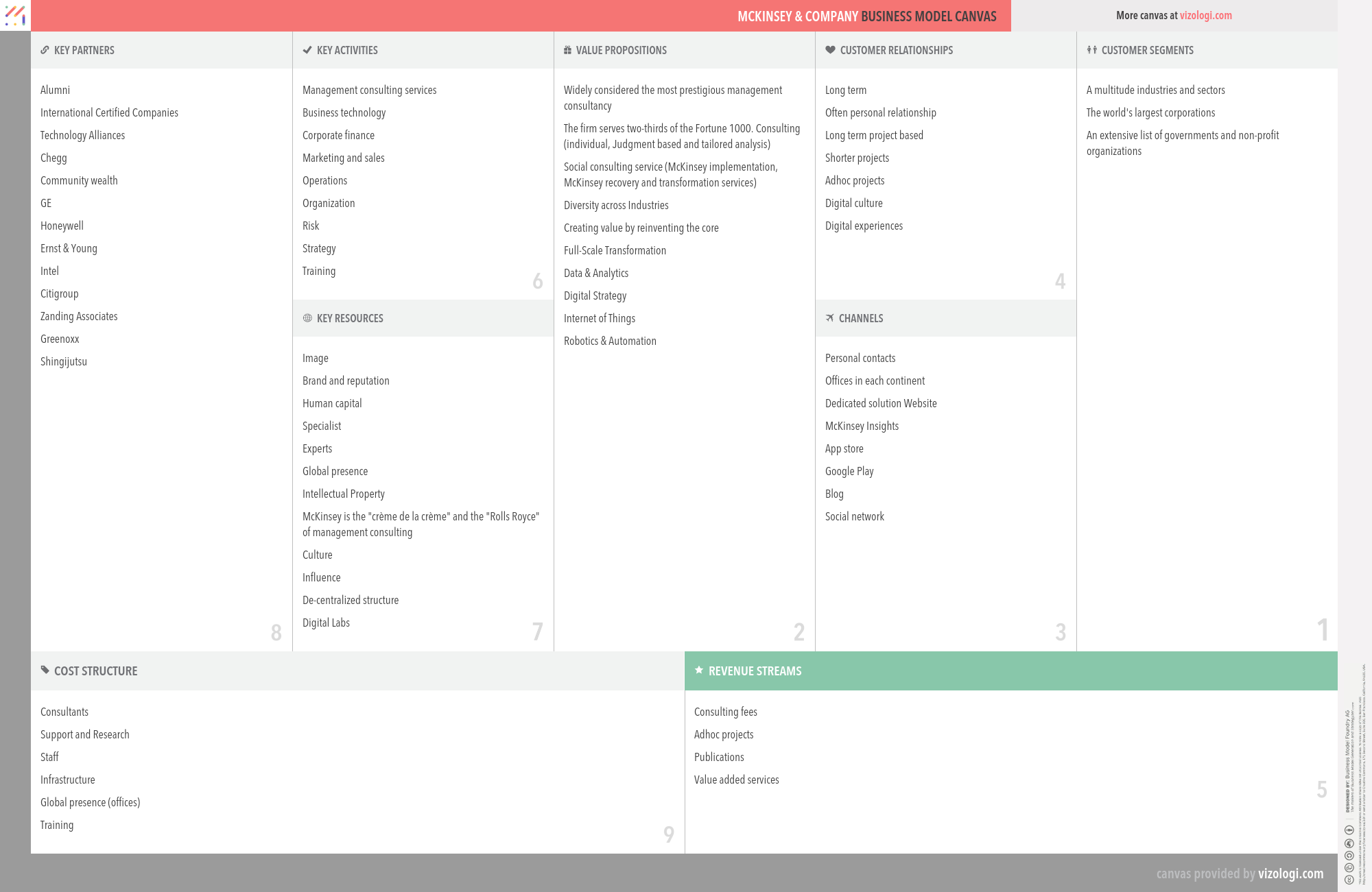

One of the primary elements of a strong financial foundation is the ability to develop a comprehensive understanding of financial statements and metrics. Founders should familiarize themselves with basic financial statements, such as income statements, balance sheets, and cash flow statements. By analyzing these statements, founders can gain valuable insights into their startup’s financial health and make informed decisions.

Additionally, founders should focus on forecasting revenue and expenses. Creating accurate financial projections allows founders to anticipate potential challenges and plan accordingly. By forecasting revenue, founders can set achievable financial goals and align their business strategies accordingly. Similarly, forecasting expenses helps founders identify areas where they can reduce costs and optimize resource allocation.

Setting financial goals is another crucial aspect of building a strong financial foundation. Founders should establish clear and measurable objectives that align with their overall business strategy. These goals can include targets for revenue growth, profit margins, or even operational efficiency. By setting financial goals, founders can track their progress and make adjustments to their strategies when necessary.

Establishing strong financial controls is equally important. Founders must implement systems and processes to monitor and control their startup’s financial activities. This includes implementing budgeting and expense tracking mechanisms, utilizing financial software, and establishing internal controls to prevent fraud or errors. Effective financial controls enable founders to maintain financial discipline and ensure the accuracy and reliability of financial data.

In conclusion, building a strong financial foundation is crucial for startup founders. By focusing on key aspects such as understanding financial statements, forecasting revenue and expenses, setting financial goals, and establishing financial controls, founders can navigate the financial challenges of entrepreneurship more effectively. Prioritizing financial knowledge and creating a robust financial plan will not only contribute to the success of the startup but also instill confidence in potential investors and stakeholders.

Making strategic financial decisions is a crucial aspect of running a successful business. For founders, having a strong understanding of finance empowers them to make informed choices that can greatly impact the growth and sustainability of their venture. By exploring financial knowledge, founders can effectively evaluate investment opportunities, assess the viability of business models, and determine appropriate pricing strategies.

One of the key benefits of having financial expertise is the ability to evaluate investment opportunities. Founders who can analyze the potential risks and returns of various investments are better equipped to make smart and profitable decisions. By understanding financial metrics such as return on investment (ROI) and net present value (NPV), founders can assess the profitability and long-term prospects of potential investments, which helps them make strategic choices that align with their business goals.

Moreover, financial knowledge allows founders to assess the viability of their business models. By analyzing financial statements and performance indicators, founders can identify areas of improvement and make necessary adjustments to their business strategies. This evaluation process helps them determine the profitability and sustainability of their venture, ensuring that limited resources are allocated efficiently and effectively.

Determining appropriate pricing strategies is another critical aspect of strategic financial decision-making. Founders with financial expertise can analyze market conditions, competition, and cost structures to set optimal prices for their products or services. They can consider factors such as profit margins, target customer segments, and perceived value to determine a pricing strategy that maximizes revenue while remaining competitive in the market.

Financial expertise also plays a pivotal role in securing funding and negotiating favorable terms. Investors and lenders often evaluate the financial acumen of founders before deciding to invest or provide financing. Founders who can demonstrate a strong understanding of their financials and effectively communicate their business’s potential are more likely to attract investors and secure funding. Additionally, financial knowledge enables founders to negotiate favorable terms, such as lower interest rates or higher valuations, which can greatly impact the financial health and growth of the business.

Lastly, being well-versed in finance helps founders attract potential investors. Investors seek founders who can effectively communicate the financial viability and growth potential of their venture. By having a deep understanding of their financials, founders can present a compelling case to potential investors, showcasing how their business aligns with the investors’ interests and goals.

In conclusion, financial knowledge empowers founders to make strategic decisions that can greatly impact the success of their business. By being able to evaluate investment opportunities, assess business models, determine pricing strategies, secure funding, negotiate favorable terms, and attract potential investors, founders with financial expertise set themselves up for long-term growth and sustainability. Therefore, acquiring financial knowledge is a vital aspect of entrepreneurship that founders should prioritize to drive strategic financial decision-making.

Mitigating financial risks and challenges is crucial for the success of any startup venture. As founders embark on their entrepreneurial journey, they must be prepared to address potential risks and challenges that may arise along the way. One of the most significant ways to handle these uncertainties is by equipping themselves with a solid understanding of financial knowledge. By acquiring this knowledge, founders can effectively identify and mitigate risks, ensuring the long-term sustainability of their business.

Managing working capital is a fundamental aspect of mitigating financial risks. It involves monitoring and controlling the company’s current assets and liabilities to ensure smooth operations. By maintaining an optimal level of working capital, founders can avoid disruptions in their day-to-day activities. This includes managing inventory, accounts receivable, and accounts payable efficiently. A strong focus on working capital management allows founders to avoid cash flow issues, ensuring that the business has sufficient liquidity to meet its financial obligations.

Addressing cash flow issues is another critical factor in mitigating financial risks. Cash flow problems can arise due to various circumstances such as delayed payments, unexpected expenses, or a sudden drop in sales. These challenges can severely hamper a startup’s operations and growth prospects. By carefully monitoring cash flow and implementing strategies to maintain a healthy cash position, founders can effectively mitigate these risks. This may involve negotiating favorable payment terms with suppliers, diversifying revenue streams, or implementing cost-cutting measures during lean periods.

Furthermore, risk management strategies play a vital role in safeguarding the long-term sustainability of a startup. Founders must identify potential risks that could impact their business and develop proactive measures to mitigate them. This can include conducting thorough market research, analyzing industry trends, and staying updated on regulatory changes. By understanding the risks associated with their industry and implementing appropriate risk management strategies, founders can protect their business from unexpected events that could lead to financial loss or even failure.

In conclusion, mitigating financial risks and challenges is crucial for the success of startup ventures. By acquiring financial knowledge, founders can effectively identify and address potential risks. Managing working capital, addressing cash flow issues, and implementing risk management strategies are essential components in ensuring the long-term sustainability of a business. By adopting these practices, founders can navigate the uncertain terrain of entrepreneurship with confidence, setting their startup on a path to success.

Continual learning and growth are crucial for founders to navigate the ever-changing landscape of finance. In a world where market conditions and industry trends are constantly evolving, it is imperative for entrepreneurs to expand their financial knowledge to stay ahead of the game. Fortunately, there are numerous resources available to help them achieve this.

One way to enhance financial knowledge is through the exploration of resources such as financial books, courses, and mentorship programs. Books written by renowned financial experts offer valuable insights and practical advice that can be applied to real-world situations. These books not only provide a solid foundation in finance but also help entrepreneurs understand complex concepts in a simplified manner.

Courses specifically designed to enhance financial literacy can also be incredibly beneficial for founders. These courses cover a wide range of topics, from basic financial principles to advanced investment strategies. By enrolling in such courses, entrepreneurs can gain a deeper understanding of financial concepts, enabling them to make informed decisions regarding their business finances.

Mentorship programs are another excellent resource for founders looking to expand their financial knowledge. Through mentorship, entrepreneurs can learn from experienced professionals who have successfully navigated the complexities of finance. Mentors can provide valuable guidance, share their own experiences, and offer practical tips that can greatly benefit founders in their financial journey.

Networking with other entrepreneurs and financial experts is yet another avenue for continuous learning and growth. By connecting with like-minded individuals, founders can gain insights into different financial strategies and approaches. Discussions with peers can shed light on potential pitfalls to avoid and innovative methods to adopt. The collective wisdom of a network can prove invaluable in expanding financial knowledge and staying abreast of emerging trends.

In conclusion, the importance of continual learning and growth in finance cannot be overstated for founders. By emphasizing the need to expand financial knowledge, entrepreneurs can adapt to evolving market conditions and industry trends. Exploring resources such as books, courses, and mentorship programs can provide the necessary tools for success. Additionally, networking with other entrepreneurs and financial experts can offer valuable insights and learnings. By prioritizing continuous learning, founders can position themselves for long-term financial success in today’s dynamic business landscape.