Diversification: Explore the concept of diversifying your investment portfolio by including alternative assets such as real estate, commodities, or precious metals. Discuss the benefits of diversification in a volatile market and how it can help mitigate risk.

Diversification: Explore the concept of diversifying your investment portfolio by including alternative assets such as real estate, commodities, or precious metals. Discuss the benefits of diversification in a volatile market and how it can help mitigate risk.

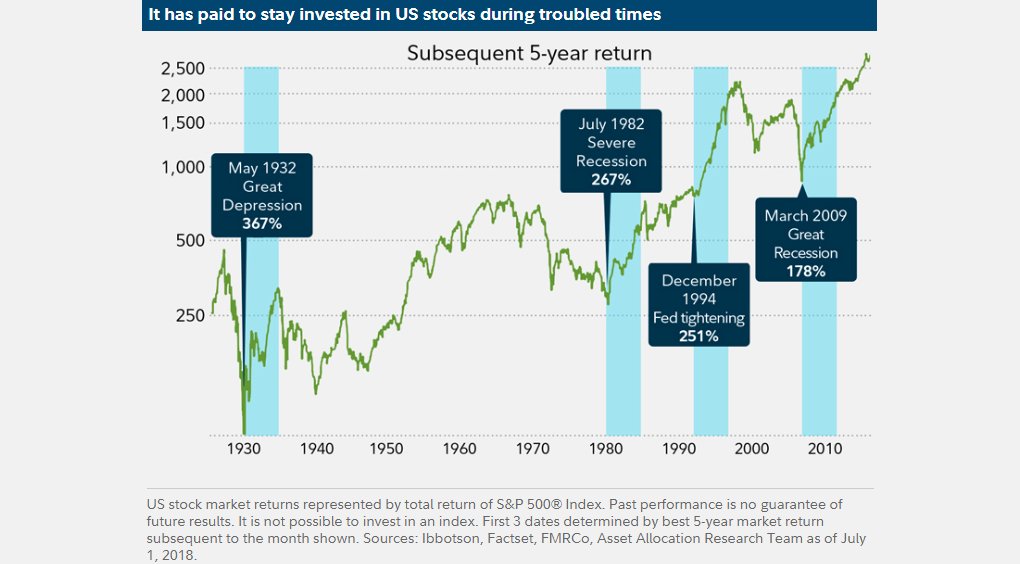

In today’s rapidly changing and unpredictable financial landscape, it is crucial for investors to consider diversifying their investment portfolios. The concept of diversification involves spreading investments across different asset classes, such as stocks, bonds, and cash. However, including alternative assets like real estate, commodities, or precious metals can further enhance the diversification strategy and help mitigate risks even in the face of market volatility.

One of the key benefits of diversification is its ability to reduce risk. By allocating investments across various asset classes, investors can reduce their exposure to any single investment or market. This means that if one asset class experiences a downturn, the negative impact on the overall portfolio is minimized because other assets may perform well or remain stable. Real estate, for example, has historically exhibited low correlation with equity markets, making it an attractive addition for diversification purposes.

Furthermore, alternative assets like commodities and precious metals offer unique characteristics that can help safeguard a portfolio during turbulent times. Commodities, such as oil, gold, or agricultural products, tend to have a low correlation with traditional asset classes. This means that their performance is often influenced by different factors, such as supply and demand dynamics or geopolitical events. Including commodities in a portfolio can provide a hedge against inflation and currency fluctuations, as their values may rise when other assets decline.

Similarly, precious metals like gold or silver have long been considered safe-haven assets. During times of economic uncertainty or market volatility, investors often flock to these metals as a store of value. Their limited supply and historical track record of retaining value make them attractive diversification options. While precious metals may not generate regular income like stocks or bonds, they can act as a reliable hedge against inflation and currency depreciation.

It is important to note that diversification does not guarantee profits or protect against losses, especially during severe market downturns. However, it can help mitigate risk and potentially improve long-term returns by allocating investments across different asset classes. By including alternative assets like real estate, commodities, or precious metals, investors can further enhance their diversification strategy and potentially achieve more stable and consistent returns.

In conclusion, diversifying an investment portfolio is a wise strategy to mitigate risk, especially in a volatile market. By including alternative assets such as real estate, commodities, or precious metals, investors can spread their risk across different asset classes and potentially enhance their returns. However, it is crucial to carefully research and evaluate each alternative asset to ensure it aligns with one’s investment goals and risk tolerance. Always seek professional advice and consider your individual circumstances before making any investment decisions.

Hedge funds and private equity can offer investors alternative investment strategies that go beyond traditional options like stocks and bonds. These investment vehicles have gained popularity in recent years due to their potential for higher returns and professional management. However, it is essential for investors to understand the associated risks before diving into these complex markets.

Investing in hedge funds provides individuals with the opportunity to diversify their portfolios and potentially achieve higher returns. These funds are managed by experienced professionals who use various strategies, such as long-short equity, global macro, or event-driven, to generate profits regardless of market conditions. Unlike traditional mutual funds, hedge funds have the flexibility to go long or short on positions, allowing them to profit from both rising and falling markets.

One of the significant advantages of hedge funds is their ability to deliver consistent returns even during market downturns. Their managers are skilled in identifying mispriced assets and market inefficiencies, which can result in substantial gains. Additionally, hedge funds often have access to exclusive investment opportunities, such as initial public offerings (IPOs) or private placements, which are not available to retail investors.

However, it is crucial to recognize the risks associated with investing in hedge funds. These investments are typically illiquid, meaning that investors cannot easily withdraw their money whenever they wish. Moreover, hedge funds often charge high fees, including management fees and performance fees, which can significantly impact overall returns. Additionally, as hedge funds utilize complex strategies, there is a higher degree of risk involved, and losses can occur if the managers’ predictions do not materialize.

On the other hand, private equity offers investors another avenue for accessing alternative investment strategies. Private equity firms invest in privately held companies, either by acquiring a controlling stake or providing growth capital to help these companies expand. By doing so, investors can gain exposure to sectors that are not accessible through traditional public markets.

One of the main advantages of private equity investments is the potential for significant returns. Private equity firms aim to maximize the value of their investments through various operational improvements and strategic initiatives. As a result, investors can reap substantial profits when these companies are eventually sold or go public.

Nonetheless, investing in private equity also comes with its own set of risks. These investments typically require a long investment horizon, often spanning multiple years. During this time, investors’ capital may be tied up, limiting their liquidity. Additionally, investing in private companies carries a higher risk compared to investing in publicly traded companies. The success of these investments relies heavily on the effectiveness of the private equity firm’s management team and their ability to execute their growth strategies.

In conclusion, hedge funds and private equity offer investors the potential for higher returns and access to alternative investment strategies. While these investments can diversify portfolios and deliver consistent profits, investors should carefully consider the associated risks. It is crucial to thoroughly research and understand the strategies employed by hedge funds and private equity firms before investing, ensuring they align with their risk tolerance and long-term financial goals.

Peer-to-peer lending and crowdfunding have emerged as popular alternative investment methods in recent years. These platforms provide individuals with the opportunity to connect with borrowers and invest in various projects, offering an alternative to traditional banking systems. In this article, we will explore the concept of peer-to-peer lending and crowdfunding, highlighting their benefits and risks.

Peer-to-peer lending is a form of lending that directly connects borrowers and investors through online platforms. Unlike traditional lending, which involves banks or financial institutions, peer-to-peer lending allows individuals to lend money directly to others. This creates a win-win situation, as borrowers can access loans at competitive interest rates, while investors earn potentially higher returns than traditional saving methods.

Crowdfunding, on the other hand, enables individuals to participate in funding projects or ventures that they find interesting or innovative. Through crowdfunding platforms, entrepreneurs, artists, and creators can pitch their ideas and attract financial support from the general public. This democratized approach to funding has opened new avenues for individuals to invest in projects they believe in, bypassing the traditional gatekeepers of finance.

Both peer-to-peer lending and crowdfunding platforms offer benefits that attract investors and borrowers alike. For investors, these methods provide the potential for higher returns compared to conventional saving options. By cutting out the middleman, investors can earn interest rates that exceed those offered by banks. Additionally, these platforms often allow investors to diversify their portfolios by spreading their investments across various projects or loans.

For borrowers, peer-to-peer lending and crowdfunding offer an alternative source of funding. Traditional lending institutions may have strict criteria that restrict access to loans, especially for individuals with limited credit history or unconventional business ideas. Peer-to-peer lending and crowdfunding platforms provide an opportunity for these borrowers to access financing that may not have been available to them otherwise.

However, it is essential to acknowledge the risks associated with these alternative investment methods. Default risks are a significant concern for investors. While platforms implement credit checks and risk assessment measures, there is still a chance that borrowers may default on their loans. Investors should carefully evaluate the risk profiles of borrowers before committing their funds.

Additionally, the lack of regulatory oversight in the peer-to-peer lending and crowdfunding space poses potential risks. Unlike traditional banking institutions, these platforms operate in a relatively unregulated environment. This lack of oversight means that investors must exercise due diligence and carefully research the platforms and borrowers they engage with.

In conclusion, peer-to-peer lending and crowdfunding platforms have revolutionized the way individuals invest and access funding. These alternative methods provide opportunities for borrowers and investors to connect directly, bypassing traditional banking systems. While the potential for higher returns and alternative funding sources is appealing, it is crucial to consider the risks involved. As with any investment, thorough research, diversification, and a cautious approach are key to mitigating risks and maximizing the benefits of peer-to-peer lending and crowdfunding.

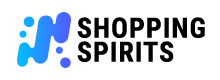

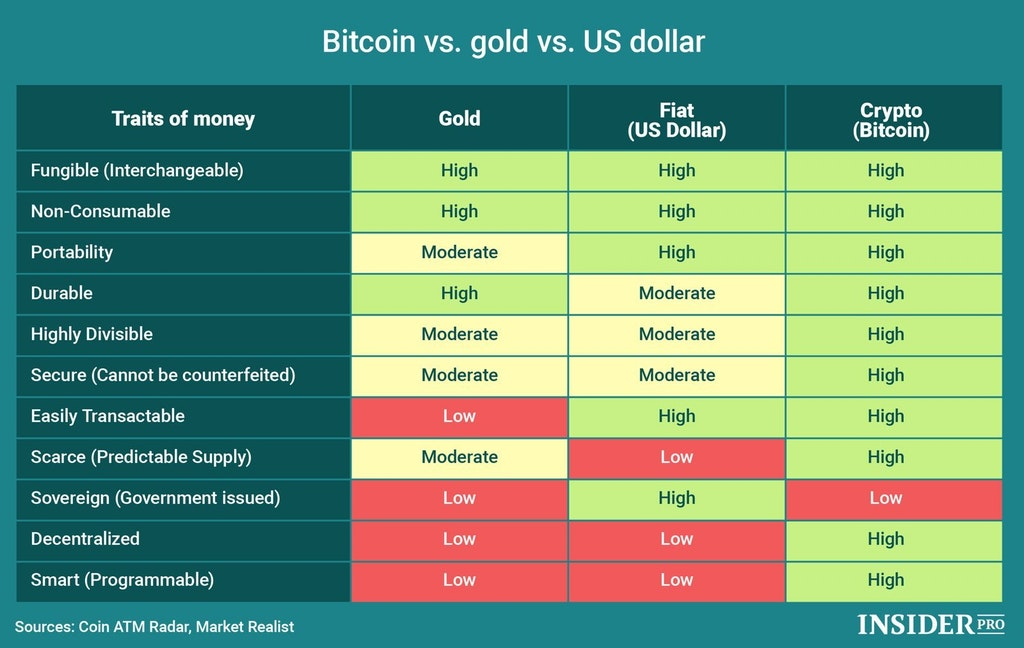

Cryptocurrencies and blockchain technology have taken the financial world by storm, offering an alternative investment method in a volatile market. With the rise of cryptocurrencies like Bitcoin and Ethereum, investors are increasingly drawn to explore the potential opportunities and risks associated with this asset class. At the heart of these digital currencies lies blockchain technology, a decentralized ledger that records transactions across multiple computers. In this article, we will dive into the fascinating world of cryptocurrencies, shed light on blockchain technology, and examine the factors that make investing in this realm both enticing and challenging.

Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant traction in recent years, captivating the attention of investors worldwide. These digital currencies operate on a decentralized network, independent of any central authority like banks or governments. The absence of intermediaries allows for peer-to-peer transactions, providing users with greater control and privacy over their financial activities. Moreover, the limited supply of certain cryptocurrencies, such as Bitcoin, has contributed to their appeal as a potential store of value.

One of the key pillars supporting cryptocurrencies is blockchain technology. Blockchain is a digital ledger that securely records and verifies transactions across multiple computers. Each transaction is stored in a “block” and linked to the previous one, forming a chain of information. This decentralized nature makes it highly resistant to fraud and tampering, ensuring the integrity of the recorded data. Blockchain technology has far-reaching implications beyond cryptocurrencies, with potential applications in various industries, including finance, healthcare, and supply chain management.

Investing in cryptocurrencies can offer attractive opportunities, but it also comes with its fair share of risks. The volatility of the cryptocurrency market is well-known, with prices experiencing significant fluctuations within short periods. While this volatility can be appealing for short-term traders, it can also lead to substantial losses. Additionally, the lack of regulation and oversight in the cryptocurrency space poses challenges for investors, as fraudulent activities and hacking incidents are not uncommon. Therefore, it is imperative for investors to conduct thorough research, understand the fundamentals of the specific cryptocurrency they wish to invest in, and exercise caution to mitigate potential risks.

Despite the risks, the potential rewards of investing in cryptocurrencies cannot be ignored. Some investors have reaped substantial profits from early investments in coins like Bitcoin, which have skyrocketed in value over time. Moreover, blockchain technology continues to evolve and disrupt traditional industries, presenting numerous investment opportunities in related projects and start-ups. As the adoption of cryptocurrencies and blockchain technology expands, the potential for long-term growth and innovation in this space becomes increasingly promising.

In conclusion, cryptocurrencies and blockchain technology have revolutionized the investment landscape, offering an alternative avenue for investors to explore in a volatile market. The rise of cryptocurrencies like Bitcoin and Ethereum, supported by blockchain technology, has captured widespread attention. However, investing in this asset class requires careful consideration and risk management due to its inherent volatility and regulatory challenges. With a thorough understanding of the intricacies and potential pitfalls, investors can navigate the world of cryptocurrencies and potentially capitalize on the opportunities it presents.

Impact investing is a growing trend in the world of finance, where investors are not only seeking financial returns but also aiming to make a positive social or environmental impact. This approach offers a unique opportunity for individuals and organizations to align their investments with their values, while still generating profits. With the increasing awareness about the urgent need to address social and environmental challenges, impact investing has gained significant momentum in recent years.

One of the key areas of impact investing is renewable energy projects. As the world grapples with the threat of climate change, there has been a surge in investments aimed at transitioning to cleaner and more sustainable sources of energy. Renewable energy projects, such as solar and wind farms, not only contribute to reducing carbon emissions but also offer attractive returns for investors. These projects often benefit from long-term contracts, government incentives, and increasing demand for clean energy, making them a safe and profitable investment option.

Another avenue for impact investing is sustainable agriculture. With the global population steadily increasing and the strain on natural resources becoming more evident, there is a growing need for sustainable agricultural practices. Impact investors can support initiatives that promote organic farming, biodiversity preservation, and fair trade, among others. These investments not only have a positive environmental impact but also contribute to food security, rural development, and the well-being of farming communities.

Social enterprises are another exciting area for impact investing. These businesses are driven by a mission to create positive change while also generating profits. They address various social or environmental challenges, such as poverty alleviation, access to education, healthcare, and clean water. Impact investors can support these enterprises by providing capital, mentorship, or expertise, thereby enabling them to scale their impact and reach a larger audience. Investing in social enterprises not only generates financial returns but also helps create sustainable solutions to social and environmental issues.

In a volatile market, impact investing offers a unique advantage. Traditional investments often face risks associated with market fluctuations, but impact investments tend to have a long-term perspective, focusing on creating sustainable positive change. This longer-term outlook helps mitigate short-term market volatility and potentially leads to more stable returns over time. Additionally, impact investments can provide diversification in an investment portfolio by encompassing a range of sectors and asset classes, further reducing risks.

In conclusion, impact investing is a growing trend that allows investors to make a positive social or environmental impact while still generating financial returns. Renewable energy projects, sustainable agriculture, and social enterprises are just a few examples of impact investment opportunities. These investments offer unique advantages in a volatile market, providing long-term stability and diversification. As more individuals and organizations recognize the importance of addressing societal and environmental challenges, impact investing is poised to play a significant role in shaping the future of finance.