The success of any trading software relies heavily on its user interface. Traders, both beginners and experts, need a platform that is intuitive and easy to navigate. A user-friendly interface ensures that traders can execute trades seamlessly, without any unnecessary complications or confusion.

The success of any trading software relies heavily on its user interface. Traders, both beginners and experts, need a platform that is intuitive and easy to navigate. A user-friendly interface ensures that traders can execute trades seamlessly, without any unnecessary complications or confusion.

One crucial aspect of a user-friendly interface is a clean and organized layout. Traders should be able to find the necessary tools and information easily without getting overwhelmed by cluttered screens. A well-designed platform will have a logical structure that groups related features together, making it easier for traders to locate and utilize them efficiently.

Clear instructions are another vital component of a user-friendly interface. Trading involves various complex processes, and traders should be guided step by step on how to perform different actions. The software should provide concise and comprehensible instructions that enable traders to make informed decisions without any ambiguity or guesswork.

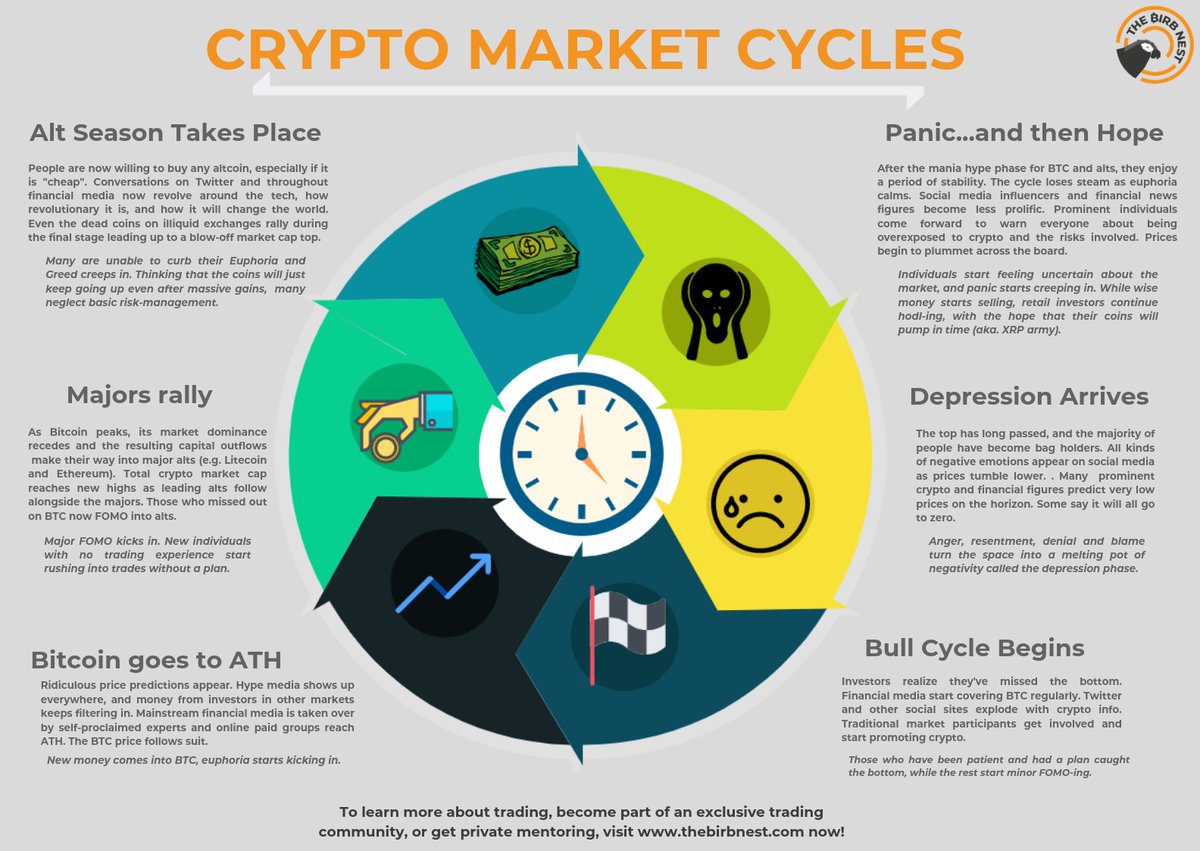

Visual aids play a significant role in enhancing the user experience. Charts, graphs, and other visual representations of market data can provide traders with valuable insights at a glance. These visual aids should be presented in a visually appealing and easy-to-understand manner. They should allow traders to analyze trends, identify patterns, and make informed trading decisions effortlessly.

Furthermore, customization options are essential for a user-friendly interface. Traders have different preferences and trading styles, and a flexible software interface should accommodate these individual needs. Customizable layouts, color schemes, and font sizes can help traders personalize their experience, making it more comfortable and enjoyable for them.

Lastly, a user-friendly interface should prioritize responsiveness and speed. Traders need a platform that can keep up with the fast-paced nature of the financial markets. Delayed or lagging interfaces can lead to missed opportunities or costly errors. A responsive interface ensures that traders can execute trades promptly, helping them capitalize on market movements effectively.

In conclusion, a user-friendly interface is paramount for any trading software. It should be intuitive, clean, and organized, allowing traders to navigate and execute trades easily. Clear instructions and visual aids enhance the user experience by providing valuable guidance and insights. Customization options cater to individual preferences, while responsiveness ensures traders can act swiftly in the dynamic world of finance. By prioritizing these elements, trading software can empower traders, regardless of their experience level, to make informed decisions and succeed in their trading endeavors.

A robust cryptocurrency trading software is not complete without advanced charting tools. These tools are essential for traders to analyze market trends, track price movements, and identify potential entry and exit points. With features such as technical indicators, drawing tools, and customizable timeframes, traders can make informed trading decisions and maximize their profits.

One of the key features of advanced charting tools is the availability of technical indicators. These indicators provide valuable insights into market trends and help traders predict future price movements. Whether it’s moving averages, RSI, MACD, or Bollinger Bands, these indicators can be added to the charts to provide a visual representation of market data. By studying these indicators, traders can identify patterns and trends, enabling them to make sound trading decisions.

Drawing tools are another important aspect of advanced charting tools. These tools allow traders to mark key support and resistance levels, draw trend lines, and highlight important chart patterns. By visually representing these levels and patterns, traders can easily identify potential entry and exit points. This helps them set up effective stop-loss and take-profit levels, reducing the risk of losses and maximizing profits.

Customizable timeframes are also a crucial feature of advanced charting tools. Traders have different trading strategies and time horizons, and having the ability to customize timeframes allows them to analyze the market from different perspectives. Whether it’s short-term scalping or long-term investing, being able to switch between different timeframes helps traders gain a comprehensive understanding of the market and make well-informed decisions.

Another advantage of advanced charting tools is the ability to overlay multiple charts. Traders can compare different cryptocurrencies or even traditional assets like stocks or commodities on a single chart. This feature allows them to identify correlations and divergences between different assets, helping them spot potential trading opportunities. By having a holistic view of the market, traders can make better-informed decisions and stay ahead of the competition.

In conclusion, advanced charting tools are an integral part of a robust cryptocurrency trading software. These tools provide traders with the necessary features to analyze market trends, track price movements, and identify potential entry and exit points. Whether it’s technical indicators, drawing tools, customizable timeframes, or the ability to overlay multiple charts, these features empower traders to make informed trading decisions and maximize their profits. So, if you’re looking to excel in the cryptocurrency market, make sure to choose a trading software that offers advanced charting tools.

Accurate and real-time market data is crucial in cryptocurrency trading. The software should provide up-to-date information on prices, order books, trade volumes, and market depth across multiple exchanges. This allows traders to react quickly to market changes and execute trades at the desired prices.

In the fast-paced world of cryptocurrency trading, timing is everything. Prices can change within seconds, and missing out on these fluctuations can result in missed opportunities or even losses. That’s why having access to real-time market data is of utmost importance.

When trading cryptocurrencies, traders need to have accurate information on hand. This includes knowing the latest prices of various cryptocurrencies, understanding the current order books, and being aware of the trade volumes happening across different exchanges. Without this information, traders would be operating in the dark, making decisions based on outdated or incomplete data.

Furthermore, market depth is another critical aspect that traders must consider. Market depth refers to the number of buy and sell orders at different price levels. By having access to this information, traders can gauge the overall market sentiment and understand the potential liquidity available for a particular cryptocurrency. It allows them to assess the supply and demand dynamics and make more informed decisions.

Having all this data available in real-time is essential because cryptocurrency markets are highly volatile. Prices can fluctuate significantly within seconds, driven by various factors such as news, market sentiment, or even a single large trade. Traders need to be able to react swiftly to these changes, and that’s where real-time market data comes into play.

With accurate and up-to-date market data, traders can set their desired prices for buying or selling cryptocurrencies. They can place orders based on the current market conditions, ensuring that their trades are executed at the desired prices. This reduces the risk of slippage, where orders are filled at different prices than intended, potentially resulting in reduced profits or increased losses.

Moreover, real-time market data also enables traders to monitor the overall market trends. By observing the price movements, order books, and trade volumes, they can identify patterns or anomalies that could inform their trading strategies. It allows them to spot potential opportunities or market inefficiencies that others might not be aware of, giving them a competitive edge.

In conclusion, accurate and real-time market data is a fundamental necessity for cryptocurrency traders. It provides them with the vital information they need to react quickly to market changes, execute trades at desired prices, and stay ahead of the competition. With the fast-paced nature of cryptocurrency trading, having access to up-to-date information is paramount for success in this dynamic and volatile market.

Security and Privacy: Cryptocurrency trading is a rapidly growing industry that attracts millions of users worldwide. With the increasing popularity of digital currencies, it becomes crucial for trading platforms to prioritize security and privacy. As users exchange sensitive personal and financial information, it is essential for the software to implement robust measures to safeguard their data.

One of the fundamental security features that should be implemented is two-factor authentication. This adds an extra layer of security by requiring users to provide additional verification, such as a unique code sent to their mobile device, along with their login credentials. By implementing two-factor authentication, trading platforms can significantly reduce the risk of unauthorized access to user accounts.

Encryption protocols are another crucial aspect of security and privacy in cryptocurrency trading. These protocols enable the secure transmission of data between users and the platform, ensuring that information cannot be intercepted or tampered with during transit. By encrypting sensitive data, such as login credentials and financial transactions, platforms can effectively protect users’ information from potential hackers or malicious actors.

In addition to implementing security measures, trading platforms should also prioritize secure wallet integration. A cryptocurrency wallet is a digital storage solution for users to securely store their digital assets. By integrating secure wallets within the trading software, platforms can ensure that users’ funds are protected from unauthorized access. These wallets should employ strong encryption techniques and follow industry best practices to safeguard users’ assets.

Compliance with industry standards and regulations is vital in ensuring the security and privacy of cryptocurrency trading. Platforms should adhere to established guidelines and regulations set forth by regulatory bodies to protect users’ funds and data. These regulations often include stringent requirements for data storage, user authentication, and risk management. By complying with these standards, trading platforms can instill trust and confidence in their users, knowing that their funds and data are being handled responsibly.

In conclusion, security and privacy are of utmost importance in the world of cryptocurrency trading. Trading platforms should prioritize the implementation of robust security measures such as two-factor authentication, encryption protocols, and secure wallet integration. Adhering to industry standards and regulations is also crucial to protect users’ funds and data. By prioritizing security and privacy, trading platforms can provide a safe and secure environment for users to engage in cryptocurrency trading with peace of mind.