Introduction to the Crypto Winter

Introduction to the Crypto Winter

The Crypto Winter, a term used to describe a prolonged period of decline in cryptocurrency prices, gripped the market from late 2017 to early 2019. During this time, the once soaring Bitcoin and other cryptocurrencies experienced a significant downturn, leaving investors and enthusiasts shocked and bewildered. This article aims to provide a brief overview of the Crypto Winter, its impact on market sentiment, and the decline in retail Bitcoin holders.

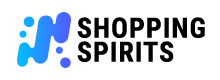

The Crypto Winter originated from the bursting of the infamous Bitcoin bubble in late 2017. Bitcoin, the pioneer cryptocurrency, had reached an all-time high price of nearly $20,000, captivating the attention of mainstream media and retail investors alike. However, the bubble eventually burst, and Bitcoin’s value plummeted, triggering a domino effect across the entire cryptocurrency market.

As cryptocurrency prices continued to plummet, market sentiment grew increasingly negative. The once optimistic and exuberant atmosphere surrounding cryptocurrencies turned into skepticism and doubt. Fearful of further losses, many investors and traders began selling off their holdings, exacerbating the downward spiral. This loss of confidence sparked a sense of caution among potential new investors, leading to a decline in overall demand for cryptocurrencies.

One of the most striking consequences of the Crypto Winter was the decline in retail Bitcoin holders. Retail investors, the individual traders and enthusiasts who had flocked to Bitcoin during its meteoric rise, found themselves caught in the whirlwind of the market’s downturn. As prices continued to fall, many retail investors faced significant losses, eroding their trust in cryptocurrencies as a viable investment.

The decline in retail Bitcoin holders was also influenced by the overall market sentiment. As doubts and uncertainties grew, many retail investors opted to liquidate their Bitcoin holdings at a loss, seeking to salvage whatever value they could. This mass exodus further fueled the Crypto Winter, creating a self-perpetuating cycle of declining prices and dwindling retail Bitcoin holders.

However, the Crypto Winter was not without its silver linings. The market correction acted as a reality check and brought to light the need for more stringent regulations and a mature approach towards cryptocurrencies. It weeded out projects and tokens with little substance, leaving only those with true potential and solid foundations.

In conclusion, the Crypto Winter was a period of significant decline in cryptocurrency prices, particularly Bitcoin, that spanned from late 2017 to early 2019. This downturn had a profound impact on market sentiment, fostering skepticism and caution among investors. Retail Bitcoin holders, once enthusiastic about the digital currency, faced losses and dwindling trust. Nevertheless, the Crypto Winter served as a wake-up call for the industry, highlighting the importance of regulatory measures and sustainable projects. As the market gradually recovers, it learns from the lessons of the past, preparing itself for a more robust and resilient future.

During the Crypto Winter, one crucial factor that emerged was the significance of increased understanding and education among retail Bitcoin holders. It became evident that individuals who had a deeper understanding of Bitcoin and its long-term potential were more likely to make informed decisions and take advantage of the market downturn by buying more BTC at lower prices.

The Crypto Winter was a challenging period for the cryptocurrency market, characterized by a significant decline in prices and market sentiment. However, those who had a better grasp of Bitcoin’s underlying technology and its potential impact on the financial industry recognized this as an opportunity rather than a setback. They understood that the temporary market downturn did not reflect the true value and potential of Bitcoin.

Educated Bitcoin holders had spent time learning about the underlying principles of blockchain technology, the decentralized nature of Bitcoin, and its potential as a store of value. Armed with this knowledge, they were able to see beyond short-term market fluctuations and recognize that Bitcoin’s long-term trajectory remained positive.

These educated individuals understood that during the Crypto Winter, the market was experiencing a correction rather than a permanent downfall. They recognized that the lower prices presented an opportunity to acquire more Bitcoin at a discounted rate. While many panicked and sold their holdings, those with a deeper understanding of the technology and its potential were able to take advantage of the situation.

By buying more Bitcoin during the market downturn, these individuals were not only increasing their own holdings but also contributing to Bitcoin’s overall liquidity. This influx of new investments helped stabilize the market and ultimately contributed to its recovery.

Moreover, the increased understanding and education among retail Bitcoin holders during the Crypto Winter had a broader impact on the cryptocurrency community as a whole. It highlighted the importance of continuous learning and staying updated with the latest developments in the industry. As more individuals realized the value of education, they sought out resources to deepen their knowledge and become more informed investors.

Overall, the Crypto Winter served as a learning experience for many retail Bitcoin holders. It emphasized the importance of increased understanding and education in navigating the volatile cryptocurrency market. Those who had taken the time to educate themselves on Bitcoin and its long-term potential were able to see through the temporary market downturn and capitalize on the opportunity to acquire more BTC at lower prices. As the market eventually recovered, these individuals were not only rewarded financially but also contributed to the overall growth and stability of Bitcoin.

Dollar-Cost Averaging Strategy:

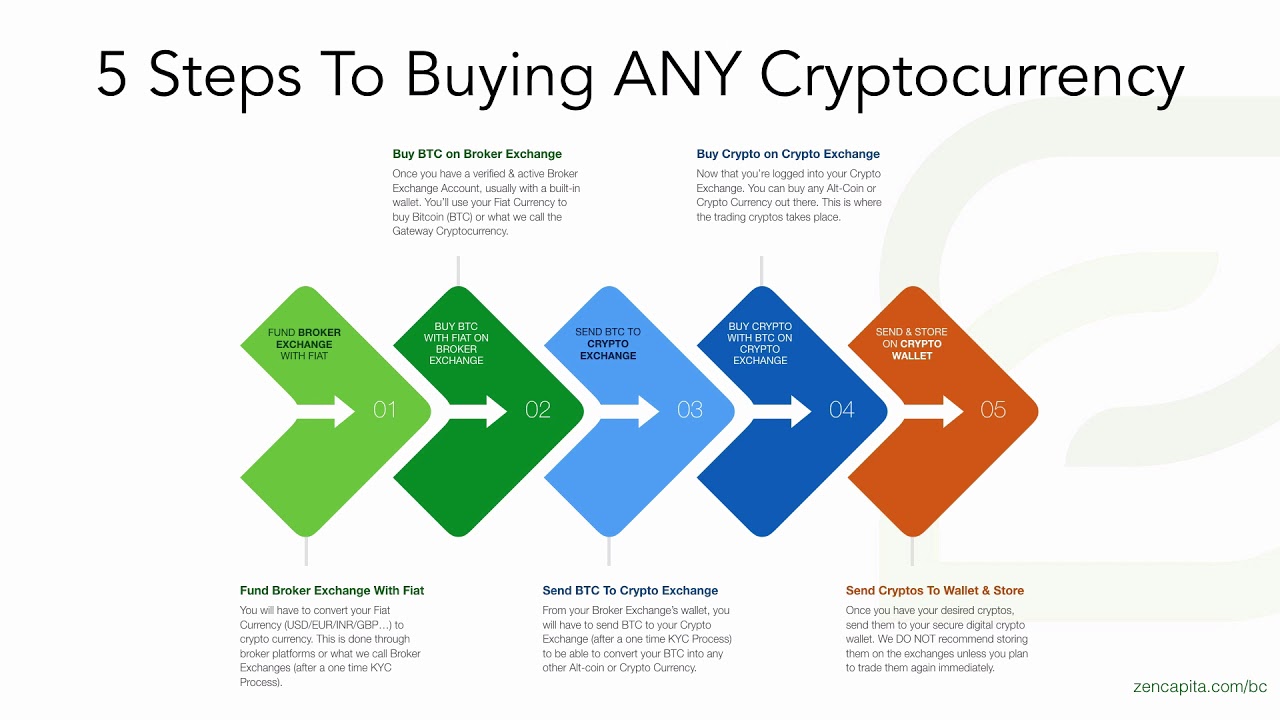

The concept of dollar-cost averaging has gained popularity among investors in recent years, offering a disciplined approach to the ups and downs of the market. This strategy involves purchasing a fixed dollar amount of an investment at regular intervals, regardless of its price. While it may seem counterintuitive to buy when prices are low, this method allows investors to mitigate the risks associated with market volatility and potentially accumulate more shares or assets over time.

During the infamous Crypto Winter, when the prices of cryptocurrencies plummeted, some retail Bitcoin holders implemented the dollar-cost averaging strategy. Rather than panicking and selling their Bitcoin holdings, they saw an opportunity to accumulate more of this digital currency at relatively low prices. By consistently buying Bitcoin, even as the market continued its downward trajectory, these investors were able to take advantage of the unfavorable conditions and potentially reap substantial rewards in the long run.

The beauty of dollar-cost averaging lies in its ability to remove the emotional aspect from investment decisions. Instead of trying to time the market and predict its highs and lows, this strategy promotes a disciplined and systematic approach. By investing a fixed amount at regular intervals, investors are shielded from the psychological pressure of making impulsive decisions based on short-term market movements. This eliminates the need to constantly monitor prices or succumb to the fear of missing out on potential gains.

For retail Bitcoin holders, the dollar-cost averaging strategy proved to be a wise move during the Crypto Winter. While some may have been disheartened by the falling prices, they recognized the long-term potential of Bitcoin and remained committed to their investment strategy. As the market gradually recovered, these investors found themselves with larger Bitcoin holdings than if they had attempted to time the market or make sporadic purchases based on fluctuating prices.

Moreover, dollar-cost averaging not only applies to Bitcoin but can be utilized with other investments as well. Whether it is stocks, bonds, or mutual funds, this strategy allows investors to smooth out market volatility and reduce the risk associated with investing a lump sum all at once. By consistently investing a fixed dollar amount, regardless of the asset’s price, investors can benefit from the average cost rather than being overly reliant on market timing.

In conclusion, the dollar-cost averaging strategy provides a sound investment approach for individuals seeking to navigate the unpredictable nature of the market. By consistently investing a fixed amount at regular intervals, regardless of the price, investors can mitigate the risks associated with market volatility and potentially accumulate more shares or assets over time. During the Crypto Winter, retail Bitcoin holders who adopted this strategy were able to take advantage of lower prices and increase their Bitcoin holdings. This disciplined and systematic approach eliminates the need to time the market, allowing investors to focus on the long-term potential of their investments rather than succumbing to emotional and impulsive decisions.

Emphasizing the Long-Term Investment Perspective during the Crypto Winter

The Crypto Winter, a period characterized by a significant market downturn in the world of cryptocurrencies, tested the resilience and conviction of Bitcoin holders. While many panicked and sold their holdings, some retail Bitcoin investors recognized the importance of adopting a long-term investment perspective. They understood that the market downturn was merely a temporary phase and firmly believed in Bitcoin’s long-term potential.

These individuals were not swayed by the short-term price fluctuations that dominated the headlines. Instead, they stayed committed to their investment and even took advantage of the lower prices to buy more Bitcoin. Their actions reflected a deeper understanding of the cryptocurrency market and a belief that Bitcoin, as the pioneer of digital currencies, had the potential to revolutionize the financial world.

By maintaining a long-term investment perspective, these retail Bitcoin holders demonstrated a level of patience and foresight that set them apart from others. They understood that short-term market fluctuations are to be expected and that the true value of an asset lies in its long-term growth potential. This mindset allowed them to weather the storm and hold on to their investments, even when the market seemed uncertain.

The decision to continue buying Bitcoin during the Crypto Winter proved to be a wise one for these individuals. As the market eventually rebounded, Bitcoin experienced significant growth, rewarding those who had remained steadfast. Not only did they benefit from the price appreciation of their existing holdings, but their additional purchases during the downturn also yielded substantial returns.

Furthermore, these retail Bitcoin investors recognized the broader implications of their actions. By consistently investing in Bitcoin, they contributed to its overall stability and market confidence. Their unwavering support sent a powerful message to the wider investment community – that Bitcoin was not just a speculative asset, but a viable long-term investment option.

It is essential to understand that the Crypto Winter was not the end of Bitcoin; it was merely a chapter in its ongoing journey. What separates successful investors from the rest is the ability to see beyond short-term fluctuations and focus on the bigger picture. By keeping a long-term investment perspective, retail Bitcoin holders were able to navigate through challenging times and position themselves for future growth.

As the cryptocurrency market continues to evolve, it is crucial for investors to recognize the significance of a long-term perspective. Short-term price movements should not overshadow the potential of cryptocurrencies like Bitcoin to disrupt traditional financial systems. By holding on to their investments and remaining committed to the long-term vision, retail Bitcoin holders exemplify the resilience and unwavering belief that will pave the way for a brighter future in the world of digital currencies.