Research and educate yourself: Begin by thoroughly researching cryptocurrencies, their functionality, and the risks associated with investing in them. Understand the different types of cryptocurrencies available and their underlying technologies. Familiarize yourself with the major players in the crypto market, such as Bitcoin, Ethereum, and Litecoin.

Research and educate yourself: Begin by thoroughly researching cryptocurrencies, their functionality, and the risks associated with investing in them. Understand the different types of cryptocurrencies available and their underlying technologies. Familiarize yourself with the major players in the crypto market, such as Bitcoin, Ethereum, and Litecoin.

Cryptocurrencies have gained significant popularity and attention in recent years, with many individuals looking to invest in this digital form of currency. However, before jumping into the world of cryptocurrencies, it is crucial to conduct thorough research and educate yourself about this complex and rapidly evolving market.

To begin, it is essential to understand the functionality of cryptocurrencies and how they work. Unlike traditional currencies issued by governments, cryptocurrencies are decentralized and operate on blockchain technology. This technology ensures transparency, security, and immutability of transactions. By researching the fundamental concepts behind cryptocurrencies, you will gain a better understanding of their potential value and risks.

Furthermore, it is vital to familiarize yourself with the different types of cryptocurrencies available in the market. Bitcoin, the most well-known and widely used cryptocurrency, paved the way for numerous other digital currencies. Ethereum, for instance, introduced the concept of smart contracts, enabling developers to create decentralized applications on its blockchain. Litecoin, on the other hand, offers faster transaction confirmation times compared to Bitcoin. By understanding the characteristics of various cryptocurrencies, you can make informed decisions about which ones align with your investment goals.

However, it is important to note that investing in cryptocurrencies involves risks. The volatile nature of the crypto market means that prices can fluctuate dramatically within short periods. Therefore, it is crucial to familiarize yourself with the potential risks associated with investing in cryptocurrencies. Understand that even the most established cryptocurrencies, like Bitcoin, can experience significant price swings. Additionally, keep in mind the potential security risks, as the digital nature of cryptocurrencies makes them susceptible to hacking and fraud.

Once you have gathered the necessary knowledge about cryptocurrencies, their functionality, and the associated risks, you can make informed investment decisions. Consider your financial goals, risk tolerance, and investment horizon before allocating funds to cryptocurrencies. Remember that diversification is key; do not allocate all your investment capital solely to cryptocurrencies but instead maintain a balanced portfolio across various asset classes.

In conclusion, before delving into the world of cryptocurrencies, it is crucial to conduct thorough research and educate yourself about this complex market. Understand the functionality of cryptocurrencies and their underlying technologies. Familiarize yourself with the major players in the crypto market, such as Bitcoin, Ethereum, and Litecoin. Lastly, be aware of the risks associated with investing in cryptocurrencies and make informed decisions based on your financial goals and risk tolerance. By being knowledgeable and cautious, you can navigate the crypto market with confidence.

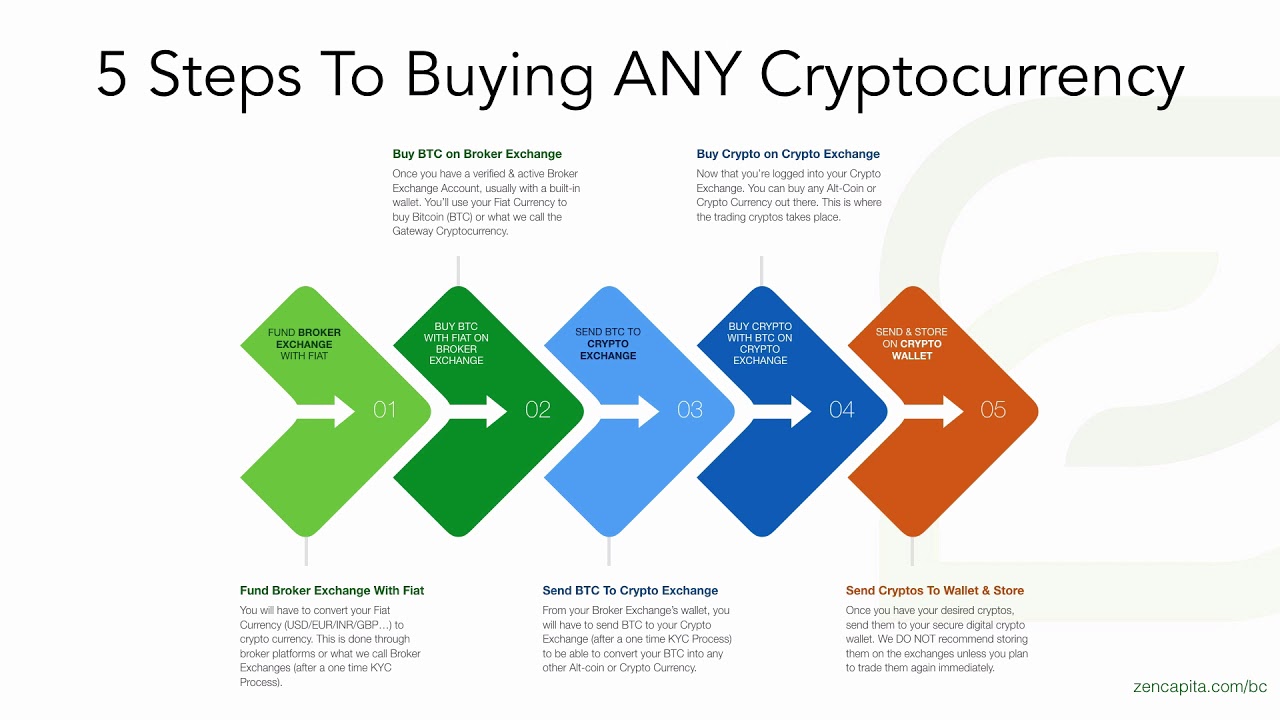

Choose a reliable cryptocurrency exchange: Selecting a reputable cryptocurrency exchange platform is crucial to ensure the safety and security of your funds. With the plethora of options available, it is important to consider certain factors before making a decision. Firstly, look for exchanges that offer a user-friendly interface, as navigating through the platform should be seamless and intuitive. This will make the trading experience more convenient and efficient. Additionally, prioritize exchanges that have robust security measures in place. Look for features like two-factor authentication, cold storage for funds, and regular security audits. These measures will minimize the risk of hacking and ensure the safety of your assets.

Furthermore, the variety of cryptocurrencies offered by an exchange is an important consideration. Look for platforms that provide a wide range of cryptocurrencies to choose from. This will allow you to diversify your portfolio and take advantage of various investment opportunities. Reputable exchanges usually offer popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, along with other promising altcoins.

Another crucial factor to consider is transaction fees. Different exchanges charge varying fees for trading activities. Therefore, it is essential to evaluate the fee structures of multiple exchanges to find the one that offers competitive rates. Keep in mind that lower fees can significantly impact your overall profits, especially if you are an active trader.

When selecting a cryptocurrency exchange, it is essential to conduct thorough research regarding the exchange’s track record. Look for information about the exchange’s history, performance, and any past security breaches. This will give you insights into the reliability and trustworthiness of the platform. Additionally, consider reading customer reviews and feedback. This will help you gauge the overall satisfaction level of users and identify any common issues or concerns.

Moreover, regulatory compliance is crucial when choosing a cryptocurrency exchange. Ensure that the exchange operates within the legal framework and complies with relevant regulations. Exchanges that adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are more likely to prioritize security and user safety.

In conclusion, selecting a reliable cryptocurrency exchange is of utmost importance to safeguard your funds and have a smooth trading experience. Choose an exchange with a user-friendly interface, robust security measures, a diverse range of cryptocurrencies, and competitive transaction fees. Conduct thorough research, evaluate customer reviews, and check for regulatory compliance before making your decision. By considering these factors, you can ensure that your funds are in safe hands and make the most of the cryptocurrency market.

Create an account and complete the verification process: Sign up for an account on the chosen cryptocurrency exchange platform. Provide the required identification documents and complete the necessary verification process. This step is crucial to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations enforced by many exchanges to prevent fraud and illegal activities.

When venturing into the world of cryptocurrencies, one of the first steps you need to take is to create an account on a cryptocurrency exchange platform. These platforms serve as the gateway to the digital currency market, allowing users to buy, sell, and trade various cryptocurrencies. However, before you can start trading, it is essential to complete the verification process.

To begin, sign up for an account on your chosen cryptocurrency exchange platform. This usually involves providing your personal information, such as your name, email address, and sometimes even your phone number. Additionally, you may be required to set up a strong password to ensure the security of your account.

Next, you will need to provide the necessary identification documents. Cryptocurrency exchanges are subject to strict regulations, particularly regarding anti-money laundering (AML) and know-your-customer (KYC) measures. These regulations are in place to prevent fraud, money laundering, and other illicit activities within the cryptocurrency market.

The identification documents you will be asked to provide may vary depending on the exchange and your location. Generally, you will need to submit a government-issued ID, such as a passport or driver’s license. In some cases, you may also be required to provide proof of address, such as a utility bill or bank statement, to verify your residential information.

Once you have submitted the necessary identification documents, the exchange will conduct a verification process. This process is designed to ensure that you are who you claim to be and to further enhance the security of the platform. The verification process may take some time, as exchanges often experience high volumes of new user registrations.

It is important to note that the verification process is not meant to invade your privacy but rather to protect you and the cryptocurrency market from fraudulent activities. By complying with AML and KYC regulations, exchanges can maintain a secure environment for traders and investors.

In conclusion, creating an account on a cryptocurrency exchange platform and completing the verification process is a crucial step for anyone looking to enter the world of cryptocurrencies. By providing the required identification documents and complying with AML and KYC regulations, you are helping to maintain the integrity of the cryptocurrency market and protect yourself from potential fraud. So, take the time to go through the verification process and get ready to explore the exciting possibilities that cryptocurrencies have to offer.

Obtaining a digital wallet is crucial for securely storing your cryptocurrencies. With the increasing popularity of digital currencies like Bitcoin and Ethereum, it is essential to adopt measures to protect your digital assets. When it comes to digital wallets, you have the option to choose between hardware wallets or software wallets.

Hardware wallets are physical devices designed specifically for storing cryptocurrencies. They offer an added layer of security as they are not connected to the internet when not in use. This isolation minimizes the risk of cyber-attacks and ensures the safety of your digital assets. Moreover, hardware wallets often come with built-in security features like PIN codes and biometric authentication to prevent unauthorized access.

On the other hand, software wallets are mobile or desktop applications that enable users to store and manage their cryptocurrencies. These wallets are convenient and accessible, allowing you to carry your digital assets wherever you go. However, it is crucial to select a software wallet that prioritizes security. Look for wallets that offer robust security features such as two-factor authentication, encryption, and multi-signature functionality. These features add an extra layer of protection against potential threats.

Researching and selecting the right digital wallet is essential for ensuring the safety of your cryptocurrencies. Take your time to explore different options and compare their security features. Look for wallets that have a strong reputation and positive user reviews. It is crucial to choose a wallet that has a track record of being secure and reliable.

Two-factor authentication is a critical security feature to consider when selecting a digital wallet. It adds an extra layer of protection by requiring users to provide two separate forms of identification before accessing their wallet. This could include a password and a unique code sent to your mobile device. By enabling two-factor authentication, you significantly reduce the chances of unauthorized access to your digital assets.

Encryption is another crucial aspect to look for in a digital wallet. It ensures that your private keys, which are necessary for accessing your cryptocurrencies, are protected. Encryption scrambles your data, making it unreadable without the correct decryption key. This feature is vital in safeguarding your wallet from potential hackers or unauthorized individuals.

In conclusion, securing a digital wallet is of utmost importance when it comes to safeguarding your cryptocurrencies. Whether you choose a hardware wallet or a software wallet, make sure to research and select one that offers robust security features. Two-factor authentication and encryption are essential elements to consider when ensuring the safety of your digital assets. Invest time in finding a reputable wallet that aligns with your security needs and preferences. By taking these measures, you can confidently manage and protect your cryptocurrencies in the digital world.